7 Essential Considerations When Evaluating a Potential MMM Partner

Marketing Mix Models (MMM) are a valuable tool for any marketer looking to understand the effectiveness of their paid media campaigns. Unlike other traditional attribution models, MMM takes a broader approach to measuring incremental impact on revenue through top-down attribution of sales or conversions among media channels and tactics. Because it captures both the immediate and long-term effects of offline activities without the need for sophisticated data integrations or IP-level data, many marketers turn to MMM to make more informed decisions about their marketing strategy. In fact, 56% of US ad buyers will focus on MMM this year, and 22% say improving MMM results is one of their top three goals in 2025.

Investing in an MMM solution is a major decision, and not all vendors are created equal. Because it requires significant resources to get started, choosing the right partner is critical. While Tatari welcomes our clients to work with external measurement partners to analyze the holistic impact of their advertising campaigns - especially on TV, we understand the importance of selecting the right vendor and approach. That’s why we’re sharing the following key factors to consider when conducting an MMM partner analysis. In addition to this comprehensive overview, we’ve distilled the details into an easy-to-read table at the end of this guide.

Is Your Brand Ready for an MMM?

Before we dive in, ask yourself if now is the right time to think about partnering with a potential MMM vendor. Internally, there may be an ongoing push for MMM due to strong industry buzz around topics like the “death of the cookie,” privacy-first attribution methods, or even the desire to add yet another data point to the sea of attribution models your team already navigates. While MMMs provide valuable insights into measuring marketing effectiveness, they work best for brands with a stable, diversified marketing mix and a record of measurable investments across multiple channels. Companies still in the early stages of testing various platforms and creative strategies – or those operating with volatile spend levels, may struggle to generate meaningful results. MMM relies on observing relatively stable correlations amongst marketing channels and conversions within long time spans of data. More established brands, especially those in industries with long consideration cycles, tend to see greater immediate value from an MMM, as their marketing mix is already diversified and less dependent on real-time attribution. If that is not where you currently are, maybe now is not the right time to think about using MMM. Don’t worry, these considerations will still be available when you're ready.

Data Requirements and Scope

Before you sign with any vendor, it’s important to consider “How much data is needed to get started?” Some MMM partners require two or three years of historical data, while others may claim to begin with less. Tatari believes that the more data you use, the better. However, there are certain situations where your advertising or product line changes rapidly, and having robust historical data may not reflect current realities.

Being clear on the volume and variety of inputs (media spend by channel, pricing data, promotional calendars, distribution coverage, and macroeconomic factors) and how these choices impact the quality of fit for your model are crucial to a successful partnership.

Granularity of Inputs and Outputs

MMMs can operate at varying levels of granularity. Some models are built off weekly aggregated spend by channel (e.g., TV, paid social, search), while others go deeper, down to daily campaign-level metrics and specific tactics within a single channel.

To help illustrate this concept, consider the following comparison table, which outlines the advantages and disadvantages of different levels of granularity—from broad channel grouping to specific daily campaign metrics:

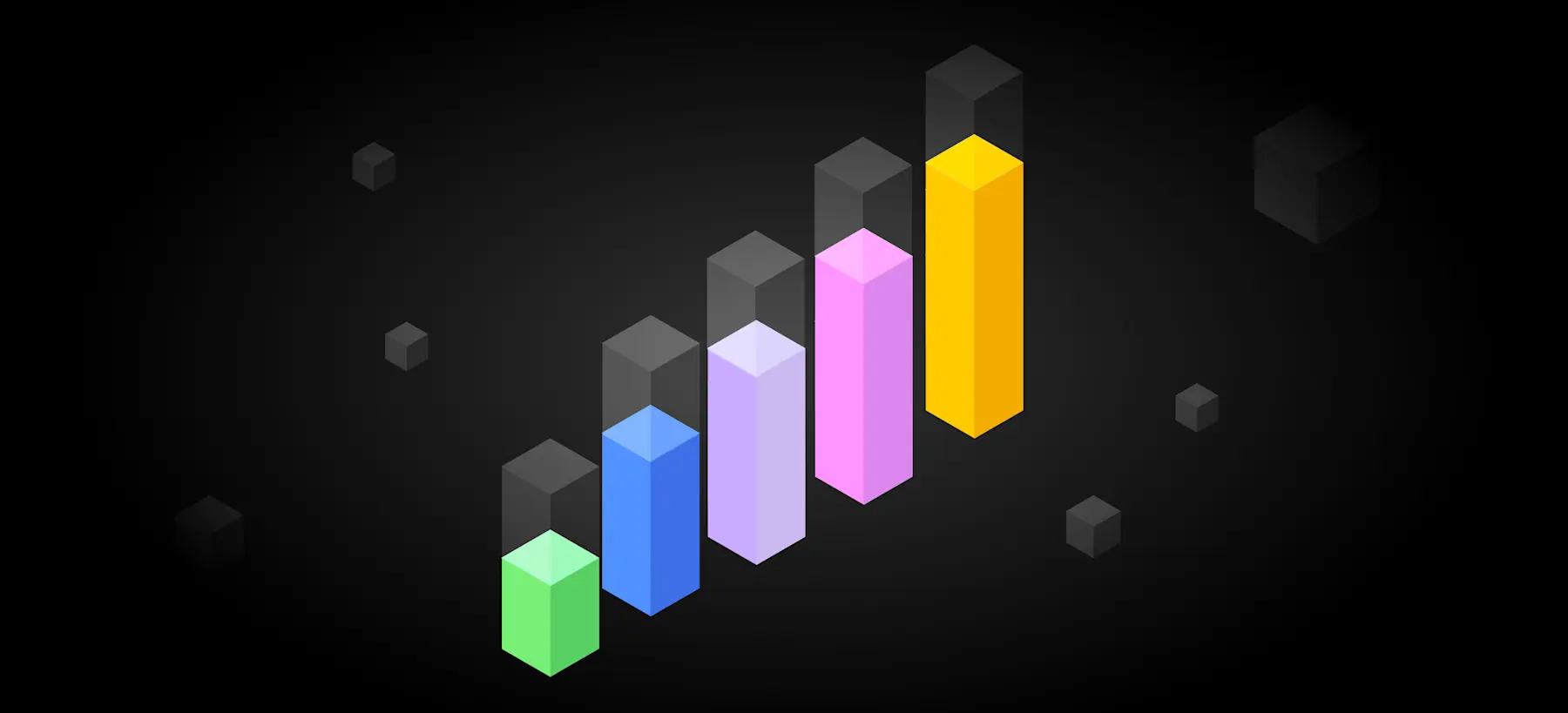

The output of an MMM varies based on the granularity of input data and the chosen model, as demonstrated in the table above. Typically, it estimates the number of conversions attributed to specific paid marketing channels over a given period. Below is an example of one output from a model fit at the weekly level, with attributed conversions (i.e., response) estimated at the marketing channel level.

In this example, each color represents the weekly conversions, or purchases in this case, attributed to a specific channel. Observing how the “slice” corresponding to each channel grows or shrinks over time helps reveal trends and seasonal patterns while highlighting relative impact amongst channels. Because this example model fits at the marketing channel level, we see consistent contribution from each channel over time, as opposed to off and on-step functions that may be observed when looking at the channel-tactic or campaign level. Additionally, since the example model operates at the weekly level, we see enough detail to identify meaningful shifts (e.g., holiday peaks, promotions, product changes, etc.) without getting lost in daily fluctuations. This showcases the effect that data granularity and the chosen model’s granularity have on the clarity and reliability of MMM results.

For models focused on conversion outcomes, Tatari advises fitting marketing mix models to weekly-level data at the marketing channel level. This avoids estimating effects for day-of-week seasonality while maintaining granular reporting capabilities. For brand-focused models, monthly-level input data may be more appropriate given the slow-to-change nature of brand health and awareness metrics.

Vendors who can handle more granular data may deliver more insights. Still, it will also demand more extensive, high-quality input data and may be prone to overfitting/highlighting erroneous results. Consider what level of detail you need and whether your vendor can provide outputs that align with your decision-making cadence.

Model Structure and Complexity

The type of modeling technique your vendor uses will impact the data requirements and the accuracy of insights. Traditional frequentist, additive models are simpler but often need more historical data to be robust and may not adapt quickly to changing market conditions. On the other hand, Bayesian or Bayesian hierarchical models can incorporate complex data structures and are more flexible, updating as new data arrives. Hierarchical models, in particular, perform better when data volumes are high, and their “hierarchical” nature can help isolate the impact of different tactics when enough data is present. The right approach depends on the complexity of your marketing ecosystem and your available data.

If specific modeling terms (frequentist, Bayesian, additive, multiplicative, hierarchical) are new to you, consider requesting more detailed explanations or additional resources from your prospective vendor. Each type of model has a trade-off between simplicity and the overall granularity of results.

Tatari recommends evaluating the need for complexity in your model, the data volume required, how often you need reporting, and how quickly the model must reflect changes in your marketing strategy to provide value to stakeholders. Vendors should be able to discuss these approaches clearly and may link you to articles, presentations, or white papers for deeper exploration.

Frequency of Refreshes and Rebuilds

Your MMM should evolve with your marketing strategy. Some vendors update models every quarter, while others do it monthly or even weekly, depending on data availability and the responsiveness you request. Understand if the vendor offers partial refreshes, updating your results with recent data versus complete rebuilds, which typically reset the model’s baseline. Regular refreshes provide more up-to-date insights but may require ongoing data alignment and internal resources while being subject to more variance in results.

Tatari typically encourages major refreshes to be performed on a quarterly basis, as incremental weeks of data should not drive substantial changes to the overall results of an MMM. If possible, consult your vendor to align refresh cadences with stakeholder reporting and planning needs. We also recommend performing a rebuild of the MMM annually or as warranted based on changes to your marketing strategy and business conditions.

Assumptions and Cold Starts

When you’re just kicking off an MMM, or starting on a new marketing channel, you may not have years of historical performance at your fingertips. In such cases, ask your vendor how they handle “cold starts.” Will they use industry benchmarks, prior attribution results, or other proxy data as a starting point? Clarify how much data is necessary to expect reliable results from the model given the length and magnitude of spending on each paid channel. Clear communication about these assumptions is crucial to ensuring the initial model results are directionally sound and relevant to your business.

Incorporating Test Results and Ground Truth

Media mix tests, hold-out experiments, or other forms of ground truth, can significantly improve your model’s accuracy. Many MMM vendors encourage and incorporate these validation data points. Suppose you regularly conduct incrementality tests (e.g., geo tests or A/B tests). In that case, your MMM partner may be able to integrate these insights to refine model parameters and increase confidence in the outputs.

Scenario Planning and Forecasting Capabilities

One of the great strengths of an MMM is its ability to inform scenario planning and forecast what happens if you shift budget from digital to TV, or launch a new campaign at a different time of year. However, not all vendors offer user-friendly tools to play out these scenarios. Some produce static reports, while others provide interactive dashboards that allow you to simulate changes on the fly.

Make sure you understand how the model’s outputs will be applied in your planning tools and what limitations exist. For example, more complex forecasting can incorporate diminishing returns or saturation effects, but the accuracy of those estimated effects depends heavily on the robustness of your underlying data and model assumptions.

In Conclusion

Choosing the right MMM vendor is not just about buying another tool to embed in your marketing stack, it's about creating a flexible, long-term partnership that adapts to your marketing strategy. A carefully implemented approach will go beyond just gathering data, it will help you uncover insights that will fuel better business outcomes. For example, MMM helped our client Saatva understand the source of their increase in inbound website traffic revenue. “We saw via one of our MMM partners that all of our TV spend correlated with lifts in overall revenue and traffic to our site,” said Alex Diesbach, Director of Digital Marketing at Saatva.

To see real success from MMM, it’s important to ensure your partner can handle the data you have (or need to gather) while being transparent about any requirements. Clarify how granular your inputs and outputs should be, and confirm that their modeling approach aligns with your data volume, business objectives, and reporting cadence. Understand how frequently they refresh or rebuild models, as well as how they handle assumptions or cold starts, especially integrating any ground-truth experiments. Finally, consider whether you want static reports or more interactive tools for scenario planning.

By balancing data needs, modeling complexity, refresh frequency, and the use case most needed by stakeholders, you’ll be on track to find an MMM solution that truly supports better marketing decisions.

Whether you're pressed for time or need a quick reference after reading our detailed discussion, this table provides the condensed insights necessary for making an informed choice.

Click here to learn more about Tatari’s MMM partners.

Brent White

I’m a Data Scientist at Tatari, where I dive into marketing mix models to help our clients scale. Outside of work, you’ll find me enduring a Chargers game, tinkering with my car, or strolling with my pup

Related

Meta’s New Ad Policies are a Disaster for Health & Wellness Brands. Here’s Why TV is the Cure.

As Meta’s new ad policies present challenges for health and wellness brands, many brands are already finding success with TV. Discover how they are driving growth and engagement on TV and how to reach audiences actively looking to make healthy choices in the new year.

Read more

How to Budget and Plan for TV in 2025

As TV continues to command a significant share of budgets, it's critical to understand the key trends that will shape the TV landscape in 2025 and what that means for advertisers. Let’s take a look at what to expect this year.

Read more

Why Streaming Was the Real MVP at this Year’s Super Bowl

The Eagles’ victory wasn’t the only surprise of the Super Bowl. Nearly 14 million people streamed the game on Tubi, shattering expectations. Tatari and TickPick saw it coming - and capitalized.

Read more