How Calm Used Digital Tactics to Master TV Brand Advertising

For context, Calm’s marketing mix has always been dominated by digital; acquiring new users on platforms like Facebook, Google Adwords, and other owned & operated properties that allow for event bidding and optimization. In 2018, they expanded to Podcasts, OOH, and TV. Calm measures attribution both through Appsflyer and a “How Did You Hear About Us” (HDYHAU) survey. And what they saw from TV was revealing; users coming in through linear TV ads were the least likely to be attributed to any digital source, which meant the traffic was highly unique and incremental.

Calm’s journey, much like most DTC brands, followed three phases.

• Phase I is about driving performance, focusing on metrics like CPI and CAC (as is the case for digital acquisition).

• Phase II is about scaling up by doubling down on what worked in Phase I, while maintaining immediate response.

• Phase III is much harder because it moves beyond the direct response tactics, and into brand objectives. We will spend most time on this.

Phase I & II: Efficiency at Scale

Using Tatari’s dashboard, the Calm team found all the TV metrics as they were used to from digital customer acquisition, CPI and CAC in particular. They get these measurements on a next day basis (even for linear airings!) with additional granularity (for example, by network, daypart, demographic, and creative). We provide two fun, but highly actionable, examples below.

Click here to continue reading the full article or watch the video.

Amit Sharan

I run marketing at Tatari and have the world's cutest french bulldog.

Related

Driving mobile acquisition through TV campaigns

Many mobile marketers tasked with driving user growth or acquisition find themselves in a similar situation. They have maxed out on digital channels like social and search, and they need to find another channel that reaches audiences at scale.

Read more

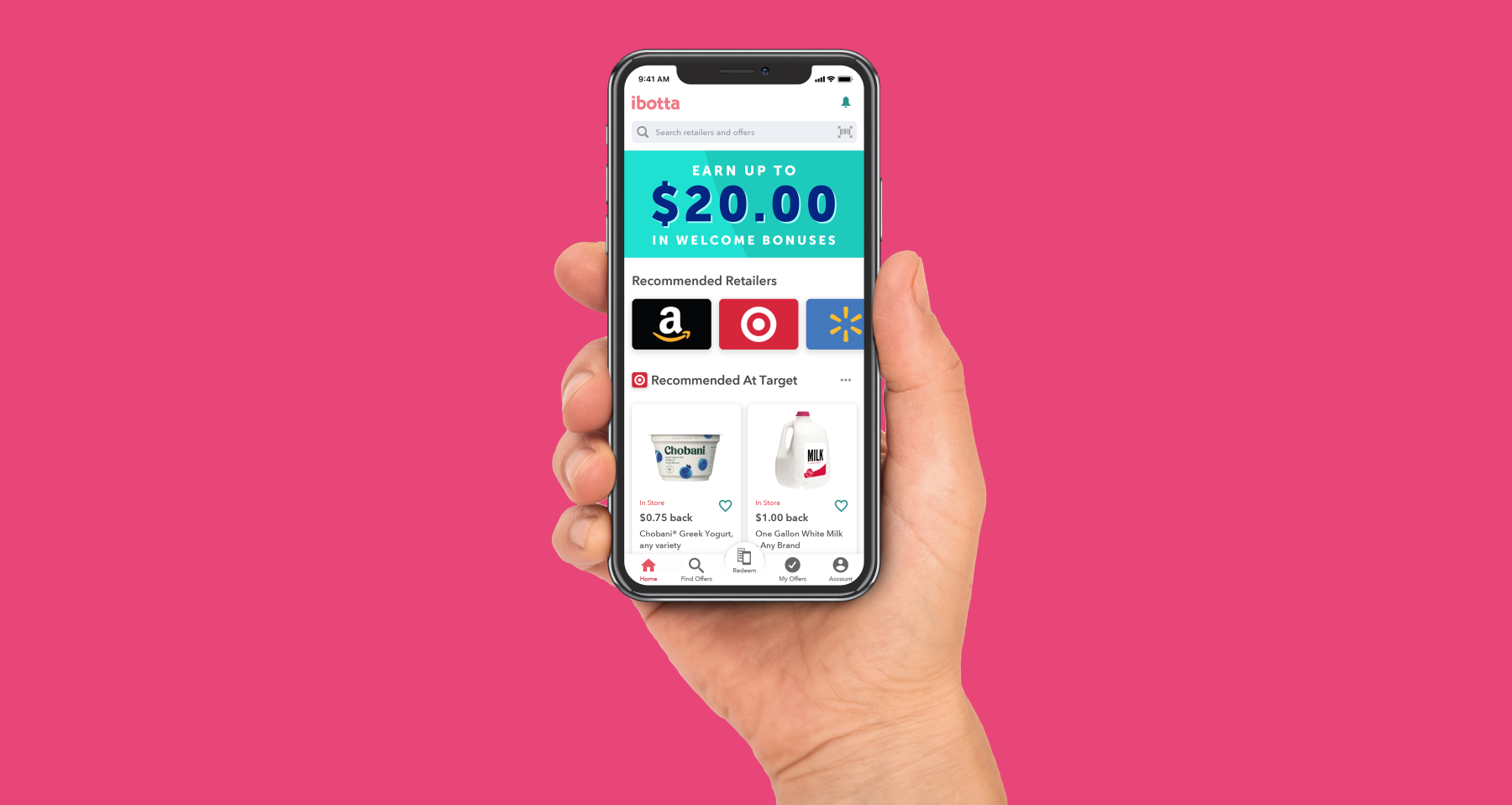

Marketing Minds: Brooke O'Brien at Ibotta

Tatari sat down with Brooke O'Brien, Marketing Manager of User Acquisition at Ibotta, to learn more about her journey and experience with TV advertising.

Read more

Avocado Mattress Proves Interactive CTV Ads are Ripe for Growth

Avocado Mattress cracked the code on streaming by turning passive viewers into active shoppers through interactive CTV ads that helped drive retail foot traffic. Explore how these emerging ad formats are finally transforming the big screen into a powerful, actionable storefront.

Read more