Separating Signal from Noise: Key Insights from ScreenShift 2025

The TV advertising landscape is saturated with buzzwords. Convergent TV. Programmatic CTV. Supply Path Optimization. AI-powered everything. At Cynopsis ScreenShift 2025 in New York City, Tatari's Chief Revenue Officer Andy Schonfeld sat down with Victoria McNally of AdExchanger to separate what's actually working from what's just marketing speak.

For media buyers, planners, and strategists navigating an increasingly complex advertising ecosystem, this conversation delivered the clarity needed to make smarter decisions about where to invest attention and budget. Here's what stood out.

What is Tatari? Understanding the Convergent TV Platform

For those unfamiliar with Tatari, Schonfeld started with context: Tatari is a technology company focused on building infrastructure for TV advertising. With roughly 300 employees—half of them in data science and engineering—the platform has evolved from its origins in measurement to become a comprehensive buying and measurement solution.

"We're a true Convergent TV platform," explained Schonfeld. "That means linear, streaming, and online video. We automate everything from direct buys—IOs, remnant inventory, scatter markets, live sports, sponsorships—to programmatic TV execution."

The platform serves over 400 brands, from household names like Chime, Nutrafol, On Cloud, and Rocket Money that operate at Super Bowl and upfront scale to emerging brands like Pholicious from Shark Tank or Mott & Bow. Tatari also works with 70+ agencies, ranging from specialized shops to major independents like PMG and Goodway Group.

With billions in media flowing through Tatari's pipes, the company has developed what Schonfeld called "a panoramic view of the TV ecosystem"—one that informs how they think about outcomes, whether that's performance metrics like visits, sales, and app installs, or brand objectives including reach, frequency, recall, and market penetration.

Why Convergent TV Still Matters: Linear Isn't Dead Yet

One of the most important questions facing advertisers today is whether to maintain a mix of linear and streaming (CTV), or go all-in on CTV as the future. Schonfeld's answer was unequivocal: brands can't afford to ignore half their potential audience.

"We don't have our head in the sand—CTV is absolutely the future (and we’ve been recognized as a leader in CTV ad tech)," said Schonfeld. "But the reality is the TV audience is still bifurcated. Nielsen's Gauge report consistently shows roughly 50% of viewership remains on linear."

Beyond the viewership split, there are practical reasons why convergent strategies outperform streaming-only approaches:

Inventory Access: Approximately 25% of streaming TV inventory is only accessible through linear buys. This includes virtual MVPDs like YouTube TV and Hulu Live, where live sports ads are still sold via traditional linear feeds. Schonfeld cited a concrete example: "During the Yankees ALDS Game 4, nine Tatari brands bought same-day spots reaching 3.5 million viewers. That inventory was only available through linear."

Cost Efficiency: Linear CPMs typically range from $1 to $5, often three to four times cheaper than streaming equivalents, providing significant cost advantages for brands looking to maximize reach within budget constraints.

Performance Impact: Schonfeld shared data from Tatari clients showing that removing linear from media mixes often degrades overall performance. "One of our long-time clients paused linear spend altogether, relying solely on streaming TV spots. Right away, we noticed CPV increased significantly and CPA trended upward. They've since moved back to a more balanced allocation."

According to Schonfeld, the key to convergence is having unified technology that can plan, buy, and measure across linear and streaming from the ground up—not legacy systems that bolt CTV onto digital display pipes or agencies that string together point solutions.

The Reality of Programmatic CTV and the "Death of the DSP"

Perhaps the most provocative topic of the conversation centered on whether programmatic would win in TV, or if reports of the DSP's demise were premature.

"Death is overstated, but value is definitely shifting," Schonfeld acknowledged. The core issue, he explained, is that most DSPs were built for display advertising and later bolted on CTV capabilities. "They simply can't reach all of TV."

While programmatic excels for certain use cases—audience extension, retargeting, lookalike modeling, and remnant inventory—Schonfeld pointed to structural limitations that make it less effective for premium TV content:

Publisher Concentration: Approximately 90% of TV impressions come from the top 10 publishers. "The need for full DSP aggregation, like you see in display or online video, just isn't there," said Schonfeld.

Premium Content Access: The content brands care most about—live sports, tentpole events, major streaming sponsorships, the Super Bowl—typically isn't available programmatically. "Chime unlocked premium live sports inventory by going direct on top of programmatic. Liquid IV scaled brand and performance the same way."

The Ad Tech Tax: Schonfeld directed attendees to adtechtax.com, where Tatari published an analysis comparing DSP markup versus direct buying from CTV publishers. "The markup is around 106%. That's essentially a 2x cost increase before your ad even runs."

The Yankees playoff example returned here as well: direct buying not only provided inventory access unavailable through programmatic pipes, but did so at significantly better economics.

Schonfeld's prediction? DSPs will survive, but TV-first platforms that can unify direct buying, programmatic execution, and measurement in one system will increasingly win market share.

Supply Path Optimization: Beyond Programmatic PMPs

Supply Path Optimization has become a buzzword in the industry, but Schonfeld argued that most "SPO solutions" are really just private marketplace deals or programmatic guaranteed inventory masquerading as optimization.

"We think about SPO differently," said Schonfeld. "About 80% of the media bought through Tatari is direct. We've automated the insertion order process and gone further with supply-side technology that plugs directly into publisher ad servers."

This approach has allowed TheViewPoint to implement direct integrations with nearly all of the top 10 CTV publishers who control 90% of impressions. The benefits are substantial:

Transparency: Direct paths to supply provide authenticated signals and clear data permissions that enable show-level transparency. "Access to dependable show-level data comes from the publisher," explained Schonfeld. "It's only available through supply paths that maintain direct relationships."

Cost Savings: By reducing intermediary hops and platform fees, direct buying creates a win-win scenario where publishers retain margin and advertisers gain cost control.

Scale and Simplicity: Agencies like PMG and Goodway Group leverage Tatari's unified planning and direct supply connections to unlock value for their clients without managing dozens of individual publisher relationships.

"If you can work directly, it's a win-win for both the publishers and the brands or agencies buying from them," Schonfeld concluded.

Privacy Solutions That Actually Work

As the industry moves beyond cookies and pixel-based tracking faces an uncertain future, advertisers need privacy-compliant measurement solutions that actually deliver results.

"You simply can't wait around if you're a brand or an agency," warned Schonfeld. "Identifiers aren't universal, so I'm not sure that's the right route."

Data clean rooms (DCRs) offer promise, but Schonfeld pointed to a critical scalability problem: interoperability. "An agency or brand can't integrate with every single DCR that different publishers prefer using. That's the reality right now."

Tatari's approach has been to build Vault, a data clean room using a server-to-server integration that fulfills privacy requirements while unlocking better measurement. The results have been eye-opening for clients:

A major telehealth company implemented Vault's post-login data integration, which revealed a conversion rate five times higher than what they thought TV was delivering. "Vault didn't change how TV was performing," Schonfeld noted. "It just made it visible."

The key insight: privacy-compliant solutions shouldn't force a trade-off between consumer protection and measurement quality. When built correctly, they can enhance both.

AI as a Business Model, Not Just a Technology

The distinction Schonfeld emphasized is that Tatari views AI as a business model, not merely a technology feature. This approach has driven measurable business outcomes:

Scaling Human Expertise: The goal isn't to replace media buyers but to amplify them. Tatari's managed service team has achieved 2x revenue growth while maintaining the same headcount—evidence that properly implemented AI scales human capability rather than replacing it.

Democratizing Expert Knowledge: Tatari's Planning Engine embeds the experience of senior buyers into tools accessible to planners at any experience level. "Not everyone is a media buyer with ten years under their belt," acknowledged Schonfeld. "That's the expertise we've baked into our Planning Engine."

Enabling New Market Entry: AI infrastructure has allowed Tatari to scale into new market segments that would be operationally unfeasible with traditional human-intensive processes. The company's agency business has grown from zero to 10% of revenue, while smaller Growth advertisers sign up daily—volume that would be impossible to manage without machine learning leverage.

Driving Performance Results: Breeo, a premium outdoor fire pit brand, used the AI-powered Planning Engine to achieve a 47% reduction in customer acquisition cost compared to their previous TV efforts—demonstrating how proper AI implementation translates to bottom-line impact.

"AI can make buyers better at their job and more efficient," summarized Schonfeld. "But it requires genuine infrastructure investment—the kind built on years of proprietary data and purpose-built technology, not just an LLM wrapper or a partnership to procure AI chips."

The Contrarian Advice Every CMO Should Hear

Schonfeld closed with advice that cuts against common industry wisdom:

"Whether you're a DTC performance brand or a Fortune 500 like Geico or Pepsi, there's always an outcome worth optimizing for—and today it's entirely possible. Too many brands chase cheap reach or narrow targeting without measuring what truly drives business outcomes."

The implication: the artificial divide between brand building and performance marketing is closing. Modern TV advertising infrastructure makes it possible to pursue both simultaneously, but only if advertisers focus on measurable business outcomes rather than vanity metrics or outdated proxies.

Key Takeaways for Media Buyers and Planners

As TV advertising continues its rapid evolution, several themes emerged from Schonfeld's conversation at ScreenShift 2025:

Convergent strategies outperform streaming-only approaches due to audience reach, inventory access, and cost efficiency—but only when supported by unified technology infrastructure.

Programmatic has a role in TV, but premium content and optimal economics increasingly require direct buying capabilities alongside programmatic execution.

Supply Path Optimization extends beyond PMPs to encompass direct publisher integrations that deliver transparency, cost savings, and scale.

Privacy-compliant measurement can enhance performance visibility when implemented through server-to-server integrations rather than fragmented clean room solutions.

AI delivers value when built on proper infrastructure and designed to scale human expertise rather than replace it with superficial chatbot interfaces.

For brands and agencies navigating the complex TV landscape, the message was clear: success requires moving beyond buzzwords to understand what's genuinely driving results. As Schonfeld demonstrated throughout the conversation, that often means challenging conventional wisdom and building capabilities that match the convergent reality of how consumers actually watch television.

Amit Sharan

I run marketing at Tatari and have the world's cutest french bulldog.

Related

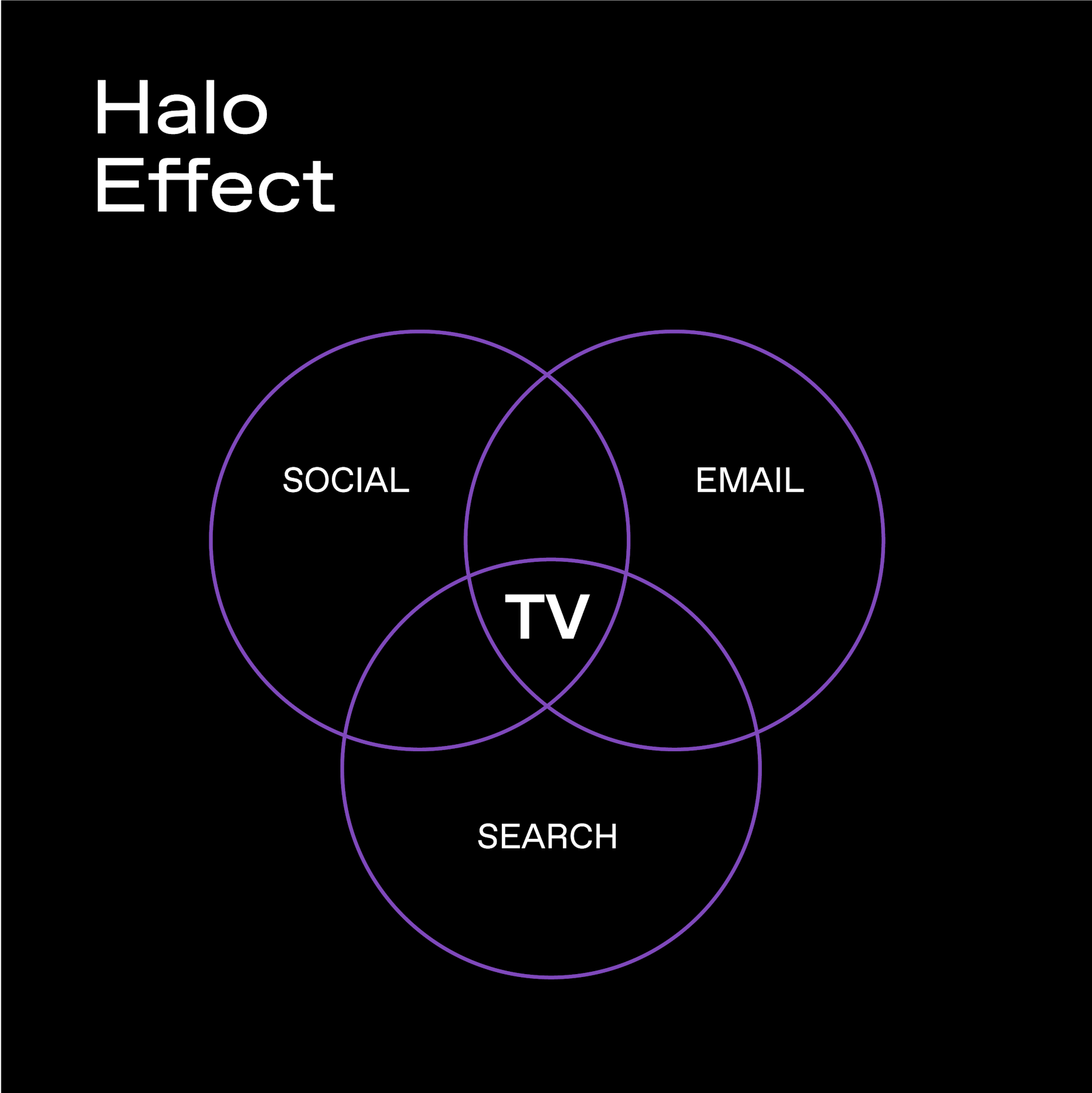

TV's Powerful Halo Effect: What It Is, How Tatari Measures It, and How You Can Harness It

Think Instagram is driving all your sales? Think again. Tatari data shows that TV ads quietly supercharge every other channel—boosting conversions on social, email, and beyond by over 50%. See how we help brands measure TV's full halo effect.

Read more

Why Streaming + Linear Work Better Together

When one advertiser shifted from a dual-channel TV strategy to streaming-only, performance quickly declined. See what happened when they turned linear back on.

Read more

Why Retargeting Might Be TV’s Smartest Entry Point

CTV is transforming traditional retargeting by combining the engagement of TV advertising with the precision of digital targeting, offering brands a low-risk, high-impact way to drive conversions and test a powerful new performance channel.

Read more