Tatari vs. MNTN: Which TV Advertising Platform Delivers Better Measurement, Attribution, and ROI in 2025

Introduction: Why This Comparison Matters

Marketers today have more options than ever to bring their ads to TV—across both linear and streaming TV (CTV) environments. Two of the most recognized TV ad platforms in this space are Tatari and MNTN.

Both promise data-driven TV performance. Yet their capabilities, transparency, and scalability differ dramatically.

This guide breaks down the Tatari vs MNTN comparison across the metrics that matter most to modern advertisers: channels supported, measurement accuracy, ease of use, cost efficiency, and scale.

Platform Overviews

Tatari: Linear TV, Streaming TV and OLV for Modern Marketers

Tatari enables advertisers to plan, buy, and measure across linear TV, streaming TV and OLV from a single platform.

Key highlights:

Platform to plan, buy, and measure linear and streaming TV ads in one place

18 patented attribution technologies for TV advertising measurement

Data-backed optimization with advanced attribution and incrementality testing

Serves 400+ leading brands across DTC, CPG, fintech, and retail

Provides direct access to premium streaming (CTV) apps and linear TV networks

AI-powered Planning Engine uses nearly a decade of performance data to quickly generate actionable media plans with predicted outcomes.

Known for modeled conversions, incrementality analysis, and direct publisher integrations with NBCU, Discovery, Disney, Netflix, Amazon, and more

Offers transparent reporting, next-day linear insights, and flexible service models — managed, semi-managed, or self-serve

Has helped small brands launch their first tv campaign and also helped reputable brands become recognized for their TV campaigns and media buying strategy, and even helped brands appear during the Super Bowl on a national level on linear and streaming, and was one of the first to get clients on the streaming-only offering of the Super Bowl.

Tatari is best suited for new TV advertisers and experienced TV advertisers and is widely recognized for its measurement accuracy, cost efficiency, and scalability.

MNTN: Performance Marketing for CTV only

Key highlights:

Self-serve platform for launching and optimizing streaming ads,

Known for celebrity spokesperson Ryan Reynolds who touts ease of use and automation

Focuses solely on Connected TV (no linear) and is only bought via programmatic

Popular among first-time TV advertisers

Offers creative support via QuickFrame and Maximum Effort studios

Provides real-time attribution through features like Verified Visits™ and Attribution Paths.

MNTN is often an entry point for digital marketers expanding into CTV for the first time, or those who need creative services, but it lacks cross-channel reach, premium inventory access, and measurement depth.

Key Differences at a Glance

Feature | Tatari | MNTN |

|---|---|---|

Channels Supported | Linear + Streaming (CTV) | Streaming only |

Self-Serve Buying Experience | Managed Service and Self-Serve | Fully Self-Serve |

Measurement & Attribution | 18 patented technologies; Advanced incrementality testing, next-day linear reporting, Tatari view-through, digital view-through | Verified Visits (view-through only) |

Inventory Access | Programmatic, and direct to publishers (including linear deals) | Programmatic, streaming publishers only; limited CTV inventory (no access to Netflix or Disney) |

Targeting | Full visibility into inventory and channels, pricing, costs, and performance | Automated black-box optimization, including display and OLV |

Ideal For | Scaling cross-channel TV with precision and control | Streaming-only campaign launches or in-house creative services |

Feature-by-Feature Breakdown

1. Channels and Inventory

Tatari offers access to both linear and CTV, empowering brands to plan convergent strategies under one roof. Unlike platforms that rely exclusively on third-party aggregators, Tatari’s access to both programmatic and direct publisher deals provide access to premium TV networks and streaming apps — ensuring better pricing, transparency, and control over placements.

According to MNTN's platform documentation and public statements, their CTV inventory focuses on programmatic exchanges, which can limit access to certain inventory and introduce more intermediaries and fees. Some CTV platforms have been reported to mix display inventory with CTV ads to improve performance metrics though specific vendor practices should be verified directly. Premium SVOD platforms like Disney+ and Netflix, which primarily sell through direct deals, may not be accessible through MNTN's self-serve platform.

Another key example is if an advertiser wants to air on the major league baseball playoffs, they must be able to buy through linear (even though the games are aired on streaming services).

Advantage: Tatari for unified TV planning and scale across every screen.

2. Measurement and Attribution

Tatari leads in TV measurement and incrementality testing, with 18 patented attribution technologies developed specifically for television advertising. Its models quantify the true lift from TV campaigns, linking impressions to site visits, modeled conversions, and rigorous attribution methods across linear + streaming.

MNTN focuses on Verified Visits, a view-through model that tracks post-ad web activity but lacks the depth of patented incrementality methodologies and sophisticated cross-platform attribution that Tatari provides.

Advantage: Tatari for transparent, rigorous, and cross-platform measurement backed by USPTO-validated proprietary technology.

3. Ease of Use

MNTN is recognized for its self-serve platform, making it a good fit for smaller advertisers who want to quickly launch and manage streaming TV campaigns with minimal setup.

Tatari has products and service models to fit advertisers at every stage of their journey. Tatari has a platform for advertisers that want to run self-serve campaigns in-house, options for in-house tools and automation alongside strategic media expertise, advanced tools for scaling brands that require strategic guidance on media plans and optimizations, as well as more control and data transparency.

Advantage: Tatari has products and service models to help a broad range of advertisers. It’s easy for small advertisers to launch quickly, yet powerful and data-transparent for large brands scaling complex TV campaigns.

4. Cost Efficiency and Transparency

Tatari provides line-item visibility into pricing and network costs, allowing marketers to optimize spend and eliminate unnecessary markups. Tatari has integrations with platforms like NBCU, recognized for transparent performance tracking.

MNTN bundles media and tech fees into automated buys, which can simplify budgeting but limit transparency.

Advantage: Tatari, for transparency, cost control and clear ROI attribution.

5. Creative and Campaign Support

MNTN integrates creative services via QuickFrame and Maximum Effort, offering in-house partnerships.

Tatari partners with a wide network of creative vendors and enables advertisers to use their own assets across both linear and streaming channels. With more brands using AI tools to generate creative for TV ads, this makes having an integrated creative service critical for a tv ad platform.

Advantage: MNTN's creative services through QuickFrame and Maximum Effort provide

integrated production support that may benefit brands without existing

creative resources or agency partnerships.

6. Data Infrastructure and Privacy

Tatari’s proprietary data infrastructure, Vault, powers secure, privacy-first data-sharing infrastructure, supporting secure attribution and ensuring compliance with evolving privacy regulations while maintaining measurement precision. Vault allows brands to share data S2S without a need for a pixel. This allows brands to unlock more insights and see the full impact of TV.

MNTN does not currently offer a comparable privacy platform; attribution is handled through in-platform pixel tracking and view-based reporting.

Advantage: Tatari — for privacy-safe data sharing and enterprise-grade measurement infrastructure.

Use Cases by Advertiser Type

For New TV Advertisers

MNTN provides a simple entry into CTV with automation and minimal setup.

Tatari offers a self-serve, in-house platform for CTV. As brands scale, Tatari offers a platform for convergent TV across CTV and linear, with support to help new TV advertisers learn attribution best practices from the start.

For Experienced TV Advertisers

Tatari’s cross-platform measurement, publisher integrations, and incrementality testing make it ideal for mature TV programs seeking accountability. Mature advertisers want both performance and brand campaigns, and Tatari has a proven track record in both areas.

MNTN’s simplicity may limit advanced optimization needs.

For Agencies

Tatari enables white-label campaign management, multi-client dashboards, and unified reporting across CTV and linear.

MNTN works best for agencies offering simple, turnkey CTV campaigns.

Cost and ROI Comparison

Factor | Tatari | MNTN |

|---|---|---|

Minimum Spend | Starts at $350 per week for self-serve retargeting campaigns on CTV. For prospecting, an advertiser must spend $5K per week. | Typically lower CTV minimums than Tatari. |

Fee Structure | Transparent pricing + direct inventory | Platform fee bundled into media |

Attribution Clarity | Modeled ROAS + View-through, and Incrementality methodologies | View-through only |

ROI Potential | High for brands investing in measurement and scale | Best for testing simple CTV campaigns |

Result: Tatari enables brands to quantify real business impact, not just view-through visits.

Final Verdict

Both Tatari and MNTN have helped redefine what “performance TV” means for modern marketers.

But for brands looking to scale, optimize, and prove ROI across the entire TV audience, Tatari stands out in 2025 for its:

Converged TV buying (across linear + streaming)

Transparent pricing and reporting

Best-in-class measurement and incrementality (awarded best CTV ad platform by digiday in 2024 and best CTV ad tech platform by Martech Breakthrough in 2025).

Strategic expert support and data control

MNTN remains a solid choice for quick-launch CTV campaigns if you're not trying to reach the entire TV audience. You can think about this as only putting your budget on instagam instead of all social media platforms like tiktok and snapchat. Tatari offers access to the entire tv audience with the depth and transparency needed to make TV as measurable and efficient as digital.

DISCLOSURE: This comparison is published by Tatari and represents our perspective on how our platform differs from competitors. We encourage you to evaluate multiple sources and request demos from all platforms before making a decision.

FAQs

What’s the biggest difference between Tatari and MNTN?

Tatari supports both linear and CTV with advanced measurement, while MNTN focuses solely on self-serve CTV.

Which platform is better for first-time TV advertisers?

MNTN offers easy setup; Tatari adds expert support and attribution tools for those serious about measurement.

Does Tatari integrate with major publishers?

Yes—Tatari has direct integrations with NBCU, Warner Bros. Discovery, Paramount, Hulu, and more.

How does measurement differ between the two?

Tatari uses incrementality testing and modeled ROAS to quantify impact. MNTN relies on view-through attribution.

Which offers more transparency in cost?

Tatari provides full visibility into media pricing and fees. MNTN bundles these into an all-in-one platform cost.

Ready to make TV measurable?

Get a Tatari demo and see how top brands use transparent data and cross-channel measurement to turn TV into a true performance channel.

Jaycee Spies

I work on product marketing and am on an endless quest for the best vanilla iced latte.

Related

How Brands are Embracing a New Playbook for TV Advertising Success

Discover how marketers are redefining TV as both a performance and brand channel, balancing linear and streaming, measuring halo effects, and making bold, data-driven bets to maximize impact.

Read more

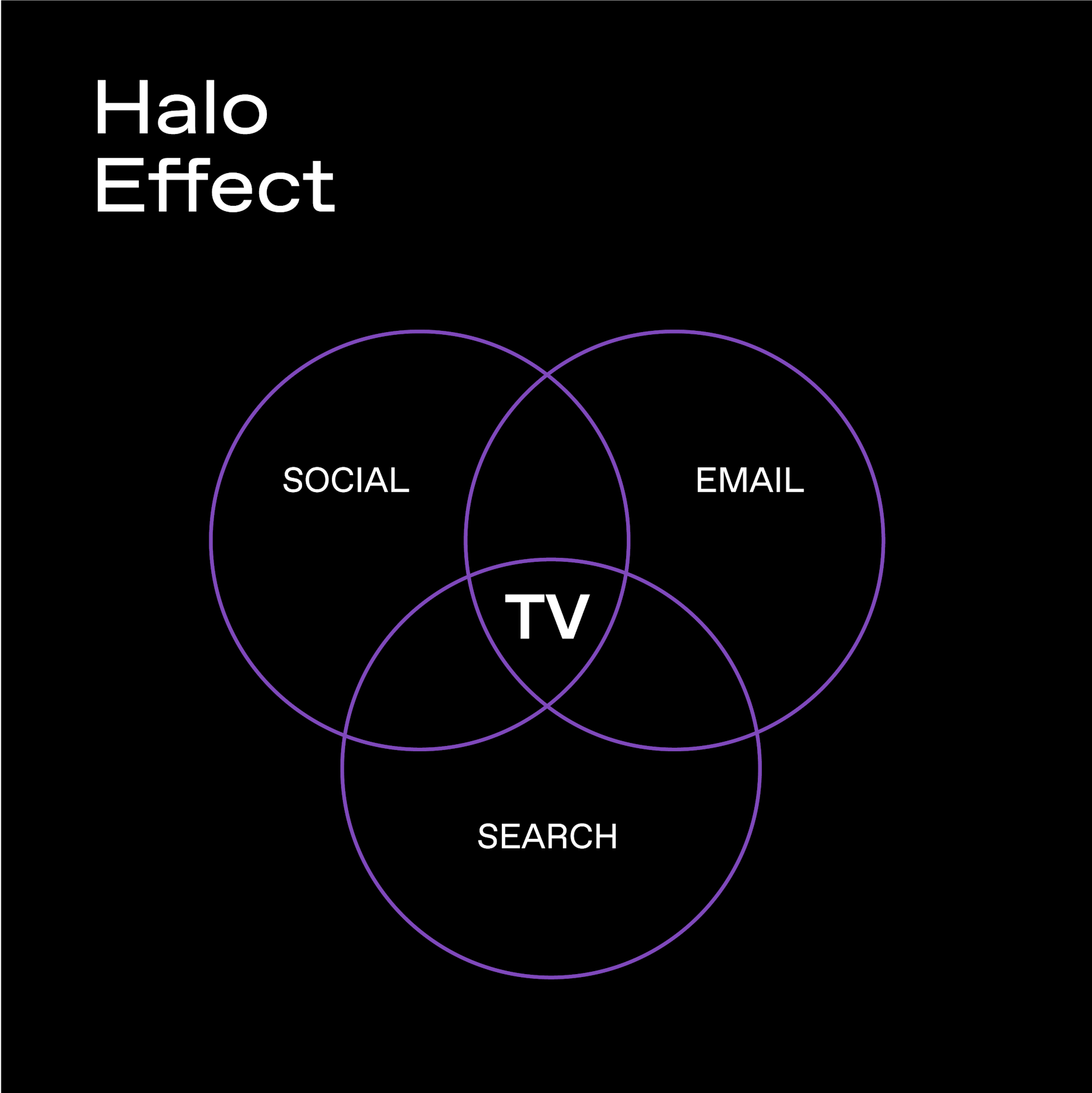

TV's Powerful Halo Effect: What It Is, How Tatari Measures It, and How You Can Harness It

Think Instagram is driving all your sales? Think again. Tatari data shows that TV ads quietly supercharge every other channel—boosting conversions on social, email, and beyond by over 50%. See how we help brands measure TV's full halo effect.

Read more

What Marketers Should Know About Peacock Advertising (Before You Buy)

Peacock’s ad-supported streaming model combines premium on‑demand programming, live sports, and targeted ad formats within a lighter commercial load than traditional television. Its tiered plans give advertisers flexible ways to reach diverse audiences while leveraging NBCUniversal’s premium content environment.

Read more