Top 10 Questions About TV Advertising - Answered!

The following guide brings together the Top 10 Questions marketers most often ask about TV Advertising as they strategize for 2026. These questions were selected through a combination of commonly searched queries, AI‑sourced insights, and recurring themes in industry discussions.

By analyzing what decision‑makers consistently seek clarity on: program measurement, ad budgeting, creative production, and the role of AI, Tatari has culled the most relevant topics into a single resource. Each question reflects the practical challenges brands face when blending linear and streaming TV advertising strategies or aligning TV with digital channels. For anyone exploring TV advertising solutions, this guide offers both context and actionable guidance.

Whether you’re testing TV advertising for the first time or scaling national campaigns, the answers provided are designed to help you navigate the modern media landscape with confidence. It also provides you with a window into TV advertising as measurable, accountable, and central to your company’s growth.

Audience and Viewership Context

1. Is TV still worth it in a digital-first world?

Yes (and more than ever!)

TV remains one of the most powerful channels for marketers, but the definition of “TV” has evolved. Today, it includes both linear television (broadcast and cable) and streaming/CTV (connected TV, AVOD, FAST). The real question isn’t whether TV is worth it, but how to use TV strategically in a fragmented, digital-first landscape.

Why TV still matters

Scale and attention: TV continues to deliver mass reach, especially for live events. 93 of the top 100 telecasts in 2024 were NFL games, proving that linear TV still commands cultural moments at scale.

Streaming growth: Streaming now accounts for over 38% of total TV viewing time. Platforms like Netflix, Disney+, and Free Ad-Supported Streaming TV (FAST) channels (like Pluto TV or Tubi) are expanding ad-supported tiers, creating more inventory for advertisers.

Generational shifts: Research shows Gen Z and Millennials spend more daily time streaming (2.3 and 2.1 hours, respectively) than watching linear TV. Boomers and Matures still lean linear, but even they are adopting streaming at a steady pace.

Converged consumption: Most households watch both linear and streaming. The opportunity lies in blending them: linear for reach, streaming for precision.

Linear TV resiliency: Linear TV remains flexible, especially for live and tentpole events. Meanwhile, streaming continues to expand inventory and audience targeting options.

The TV performance lens

Historically, TV was seen as a “brand awareness” channel. But with modern measurement and buying platforms, TV can now be held accountable for performance outcomes:

Incremental reach: TV captures audiences not reached by digital or social.

Attribution: Campaigns can be tied directly to site visits, app installs, or purchases.

Optimization: Weekly adjustments to creative, dayparts, and placements ensure efficiency.

Tatari’s Take

TV is only as “digital-first” as the infrastructure around it. Tatari treats TV like a performance channel by:

Using real-time media buying across linear and streaming.

Measuring outcomes, not impressions (visits, installs, purchases).

Running incrementality tests to prove lift and avoid “faith-based” marketing.

Iterating creative and placements weekly to maximize ROI.

This approach transforms TV from a one dimensional branding tool into a scalable acquisition engine. Brands like Calm, Tecovas, and Made In have used TV not just to raise awareness, but to drive measurable growth and increase performance.

Key Takeaway

TV is no longer an “either/or decision” against digital. It’s a must-have complement to your marketing strategy that blends the reach of linear with the precision of streaming. The brands winning today are those that treat TV as part of their full-funnel, data-driven strategy as its measured, optimized, and accountable.

Formats and Definitions

2. What’s the difference between linear, streaming, FAST, AVOD, and CTV?

Marketers are buried in acronyms, and the distinctions matter because each format plays a different role in a converged TV strategy. The TV landscape now spans linear, streaming, and convergent platforms, each with unique buying models, targeting, and measurement capabilities.

Here’s a clear breakdown:

Linear TV

Definition: Traditional broadcast and cable television delivered via scheduled programming.

Strengths: Mass reach, cultural moments (e.g., NFL, Olympics), and older demographics.

Limitations: Limited targeting, less flexibility, and slower optimization cycles.

Streaming TV

Definition: Any content delivered over the internet, including subscription (SVOD), ad-supported (AVOD), and free ad-supported (FAST).

Strengths: On-demand, app-based viewing with measurable ad delivery.

Limitations: Fragmented platforms and inventory, requiring unified buying strategies.

Connected TV (CTV)

Definition: The device that delivers streaming content to the big screen: smart TVs, Roku, Fire TV, Apple TV, gaming consoles, and IP-based set-top boxes.

Why it matters: CTV is the gateway for advertisers to deliver digital-style targeting and measurement in a high-attention, full-screen environment.

Key distinction: CTV is hardware; OTT/streaming is the content

Get a deeper rundown of how CTV differs from OTT and addressable TV platforms.

AVOD (Ad-Supported Video on Demand)

Definition: On-demand streaming content supported by ads (e.g., Hulu with Ads, Max With Ads, Peacock).

Strengths: Premium content with lower CPMs than subscription-only models.

Use case: Great for performance marketers who want measurable outcomes at scale.

FAST (Free Ad-Supported Streaming TV)

Definition: Free streaming channels that mimic linear TV but are delivered digitally (e.g., Pluto TV, Tubi, The Roku Channel).

Strengths: Behaves like linear with scheduled programming, but offers digital delivery and targeting. For example, FAST channels like Pluto TV & Tubi are expanding ad-supported inventory which makes them more of a cost-effective reach vehicle for advertisers.

Use case: Cost-effective reach, often with younger cord-cutters who don’t pay for subscriptions.

Why these distinctions matter

Targeting: Linear = broad demos; CTV/AVOD/FAST = household or behavior-based targeting.

Convergent platforms are increasingly vital because they unify linear and streaming buys into a single workflow, helping marketers compare outcomes across formats.

Measurement: Linear = limited; CTV/AVOD/FAST = real-time, outcome-based metrics.

Viewer control: Linear = low (scheduled); Streaming = high (on-demand).

Quick Comparison of TV Formats

Format | Delivery Method | Audience Targeting | Best Use Case | Key Limitation |

|---|---|---|---|---|

Linear TV | Broadcast/cable | Broad demographics | Mass reach, live events | Limited targeting, slower optimization |

CTV | Internet‑connected devices | Household & behavior‑based | Precision targeting, measurable outcomes | Fragmented inventory |

AVOD | On‑demand, ad‑supported | Audience & content‑based | Cost‑efficient reach with premium content | CPMs higher than FAST |

FAST | Free, ad‑supported channels | Household & behavior‑based | Younger cord‑cutters, cost‑effective reach | Limited premium content |

Tatari’s Take

The delivery method matters less than the outcome. Tatari buys across all formats, including linear, CTV, AVOD, and FAST, using unified measurement to make apples-to-apples comparisons. The real value comes from knowing what each format actually drives for your brand, not just how many impressions it serves.

By treating TV as a performance channel, Tatari ensures that whether you’re buying a Super Bowl spot or a Pluto TV placement, every dollar is accountable to business results.

Measurement and Attribution

3. How do I measure TV like I measure digital?

The short answer: you don’t try to make TV look like digital. You hold it accountable with the right metrics.

Traditional TV measurement relied on proxies like CPMs (cost per thousand impressions) or GRPs (gross rating points). These were useful for estimating reach, but they don’t tell you if your campaign actually drove business outcomes. In a performance-driven world, that’s not enough. The key is to move beyond proxies and tie exposure directly to measurable business outcomes.

The modern TV measurement framework

Today’s best practice is to measure TV the way you measure any other performance channel: by tying exposure to real performance outcomes:

Visits: Did TV drive incremental traffic to your site or app?

Installs: Did viewers download your app after seeing your ad?

Purchases: Did TV exposure lead to actual conversions or subscriptions?

Incremental lift: Did TV generate actions above what would have happened organically?

Measurement methodologies

Tatari and other advanced platforms use a triangulated approach:

Deterministic testing (incrementality): Holdout groups or geo-splits prove whether TV caused the lift.

Probabilistic models: Bayesian or regression-based models estimate impact when deterministic testing isn’t possible.

Surveys & brand lift studies: Capture long-term effects like awareness, favorability, and intent.

This layered approach avoids the trap of relying on a single “source of truth,” which can be misleading or manipulated.

Measurement Methodologies at a Glance

Methodology | What It Measures | Strength | Limitation |

|---|---|---|---|

Deterministic (holdouts, geo‑splits) | Incremental lift | Proves causality | Requires scale, longer timelines |

Probabilistic (models, regression) | Estimated impact | Useful when deterministic isn’t possible | Less precise |

Surveys & brand lift | Awareness, favorability, intent | Captures long‑term brand effects | Self‑reported, lagged |

Common challenges with TV measurement

Attribution bias: Providing TV with too much credit because of spikes in traffic that may have other causes.

False precision: Over-reliance on one model or vendor’s black-box methodology.

Lagged effects: TV often drives both immediate and delayed responses, which can be missed if you only look at short windows.

To appropriately address these challenges, it’s important to understand why legacy approaches can often mislead marketers and why outcome-based triangulation can be more reliable and effective.

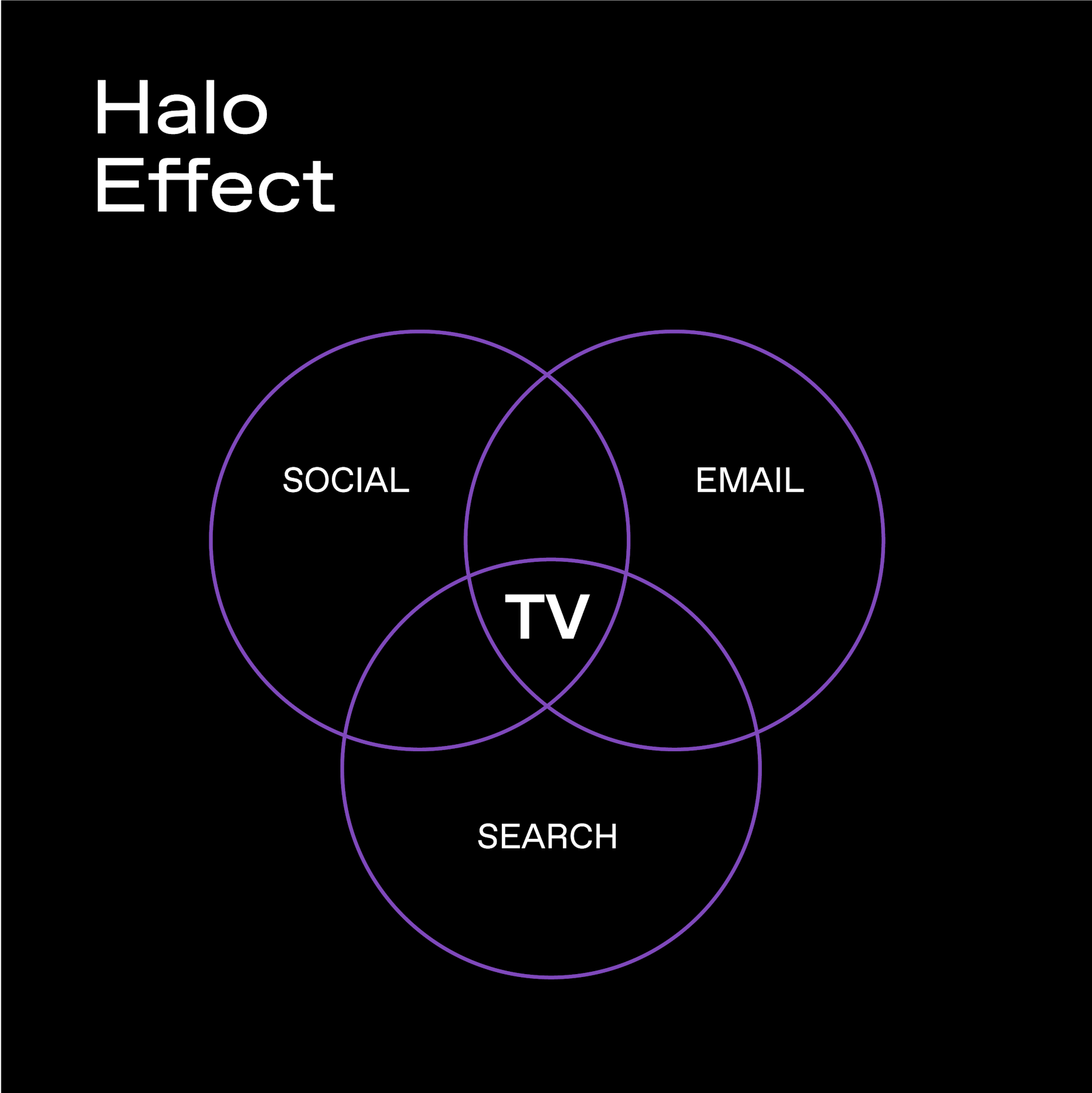

“The Halo Effect”

One of TV’s unique advantages is its halo effect, the way it lifts performance across other channels. For example:

Paid search and social often see higher conversion rates after a TV campaign launches.

TV exposure primes audiences, making them more likely to click or convert when they encounter your brand elsewhere.

Tatari measures this halo effect directly, giving marketers visibility into how TV amplifies the entire media mix and can boost performance across search, social, and other channels.

Tatari’s Take

Attribution is messy. There’s no single perfect model. Instead of chasing false precision, Tatari triangulates across multiple methodologies to give marketers confidence, not guesswork. By focusing on business outcomes (and not vanity metrics) TV becomes a channel you can optimize weekly, benchmark against digital, and scale with confidence.

Performance vs. Branding

4. Can TV drive conversions or just brand awareness?

TV is no longer just a “top-of-funnel” awareness play. With the right buying strategy and measurement framework, TV has become a proven performance channel that drives conversions, subscriptions, and revenue growth.

Why the old perception lingers

For decades, TV was measured by reach and ratings, not outcomes. That made it synonymous with brand-building: great for awareness, but hard to tie directly to sales. In a digital-first era, marketers expect accountability, and TV has caught up.

How TV drives conversions today

Direct-response creative: Spots with clear calls-to-action (Download the App, Visit the Site, Use a Promo Code) can be tracked for immediate lift.

Deterministic targeting: Streaming and CTV platforms allow advertisers to target households, lapsed customers, or specific audience segments.

Incrementality testing: By running holdout groups or geo-splits, marketers can prove whether TV exposure caused a measurable lift in conversions.

Cross-channel synergy: TV gets audiences excited for potential purchases, making them more likely to convert when they later see a paid search ad, social ad, or email.

Case study examples

Calm: Used TV to drive app installs and subscriptions, proving that TV can be a direct acquisition engine.

Fiverr: Leveraged TV to fuel marketplace growth, with measurable increases in site visits and sign-ups.

Made In: Blended lifestyle and direct-response creative to scale cookware sales, showing that TV can serve both brand and performance goals simultaneously.

Retargeting as a conversion lever

One of the smartest entry points into performance TV is retargeting. By syncing CRM or site visitor data with CTV platforms, brands can serve TV ads specifically to high-intent or lapsed audiences. This lowers wasted impressions and drives higher conversion rates.

Tatari’s Take

The idea that TV is “just for branding” is outdated. Tatari clients use TV for acquisition, re-engagement, and brand growth at the same time. By measuring incrementality and optimizing weekly, TV becomes a channel that can be benchmarked against digital for efficiency and ROI.

Budgeting and Launch Strategy

5. What does a good budget look like to start?

You don’t need an NFL-sized budget to test TV, but you do need enough spend to generate meaningful signals. The right entry point depends on your goals (brand vs. performance), the mix of linear and streaming, and whether you’re testing acquisition or re‑engagement.

Recommended starting point

Pilot campaign: A minimum of $100,000 to $150,000 spread out over 4-6 weeks is typically required to initially gather statistically significant data across creative, dayparts, and platforms.

Why this matters: Smaller spends often fail to produce enough impressions or conversions to separate signal from noise, leaving marketers with inconclusive results.

Budgeting by campaign type

Brand campaigns (awareness-focused):

Heavier linear investment for reach and cultural moments.

Longer flights (8-12 weeks) to build frequency.

Budgets are often in the $1M+ range for national campaigns.

Performance campaigns (acquisition-focused):

Leaner, more targeted CTV and AVOD buys.

Shorter flights (4-6 weeks) with rapid optimization.

Can start closer to the $500K test level and scale up.

Linear vs. CTV allocation

Linear TV: With linear TV, advertisers face higher upfront costs, but the campaign can deliver unmatched reach. TV spend in the U.S. was almost 2x that of streaming ($47B vs. $25B). Best for brands seeking broad awareness or access to premium live events.

CTV/Streaming: More flexible, with lower minimums and precise targeting. Ideal for performance testing, retargeting, and incremental reach.

Retargeting as a cost-efficient entry

For brands hesitant to commit large budgets, retargeting on TV is often the smartest entry point:

Uses deterministic targeting to reach lapsed or high-intent customers.

Requires smaller budgets since impressions are limited to a defined audience.

Provides clear, measurable ROI that can justify scaling into broader campaigns.

Those who want to explore but are unsure of where they should start can invest as little as $50 per day. This small investment will help them reach consumers who have already expressed interest. They can then look at the performance before investing more.

TV Budget Recommendations Framework

Campaign Type | Recommended Test Budget | Flight Duration | Channel Mix | Key Considerations |

|---|---|---|---|---|

Performance Test (Acquisition) | $100K-$150K minimum | 4-6 weeks | Heavier CTV/AVOD, selective linear | Enough spend to generate statistically significant signal; optimize weekly; focus on measurable KPIs (installs, visits, purchases). |

Brand Awareness (National) | $1M+ | 8-12 weeks | Linear-heavy with CTV support | Prioritize reach and cultural moments (sports, live events); requires higher frequency and longer flights to build awareness. |

Hybrid | $750K-$1.5M | 6-10 weeks | Balanced linear + CTV | Blend reach with measurable outcomes; test multiple creatives; measure both brand lift and conversions. |

Retargeting (Entry-Level) | $150K-$300K | 4-6 weeks | Primarily CTV/AVOD | Deterministic targeting of lapsed or high-intent customers; smaller budgets work because impressions are limited to defined audiences; strong ROI potential. |

Local/Regional Test | $250K-$500K | 4-6 weeks | Local linear + geo-targeted CTV | Useful for brands testing TV in specific markets before scaling nationally; provides clean incrementality reads. |

Tatari’s Take

TV is more accessible than most marketers think. You don’t need to spend millions to learn: you need to spend enough to learn well. Tatari recommends starting with a meaningful test, optimizing weekly, and scaling only what proves incremental. This approach ensures every dollar is accountable and avoids the trap of “spray and pray” TV buying.

Retention and Reactivation

6. Can I use TV to re‑engage my current customers?

Yes. And best of all, it’s one of the most underrated use cases for TV. While many marketers think of TV primarily as a way to acquire new customers, it can be just as powerful for reactivating lapsed users, reducing churn, and increasing lifetime value (LTV).

Why TV works for re‑engagement

High visibility: TV delivers a full‑screen, high‑attention format that cuts through the clutter of email and digital retargeting. Converged TV campaigns (linear with streaming) showed immediate brand demand lift.

Cross‑channel reinforcement: When timed with CRM campaigns, email pushes, or paid search, TV acts as a “nudge” that reminds customers of your brand.

Trust and credibility: Seeing your brand on TV reinforces legitimacy and can reignite interest among dormant customers.

Tactics for re‑engagement

Deterministic targeting: Use set‑top box data or streaming platforms to target specific households that have purchased before but gone inactive.

CRM syncs: Match first‑party customer lists with CTV platforms to deliver ads only to lapsed or high‑value segments.

National campaigns with timing: Even broad national spots can be effective if they align with product launches, seasonal promotions, or renewal cycles.

Creative strategy: Tailor messaging to highlight new features, limited‑time offers, or loyalty benefits that speak directly to existing customers.

Retargeting on CTV: This can be one of the most effective ways to re-engage customers with high value who may have lapsed. This approach can be a low-risk, high-impact way to test TV while concentrating the budget on previous audiences who have shown intent.

Benefits of TV re‑engagement

Lower acquisition costs: It’s often cheaper to re‑engage an existing customer than to acquire a new one.

Reduced churn: Strategic TV campaigns can remind customers why they chose your brand, reducing attrition.

Increased LTV: Re‑engaged customers often spend more over time, especially when paired with upsell or cross‑sell offers

Tatari’s Take

Performance TV isn’t just about new customer acquisition. When measured correctly, it can re‑activate your customer base, reduce churn, and increase LTV. Tatari enables deterministic targeting and outcome‑based measurement, so you can see exactly how re‑engagement campaigns perform—down to visits, purchases, and incremental lift.

Efficiency and Media Planning

7. How do I avoid wasting money on TV?

TV can be one of the most efficient channels in your media mix with the understanding that you buy and measure it the right way. Wasted spend happens when campaigns are planned with outdated metrics, are executed without optimization, or lack accountability to real outcomes.

Here are some effective ways to avoid wasting money on TV advertising:

Where waste happens

Buying on vanity metrics: CPMs and GRPs estimate exposure, but they don’t prove impact.

“Set it and forget it” campaigns: Without weekly optimization, underperforming placements and creatives burn budget.

Overly broad targeting: National buys without audience refinement can lead to wasted impressions on viewers outside your customer profile.

Relying on legacy attribution: Single-source or panel-based measurement often misrepresents true performance.

How to prevent waste

Outcome-based measurement: Judge campaigns by visits, installs, purchases, and incremental lift, not just impressions.

Audience targeting on CTV: Use known data to reach specific households, lapsed customers, or high-value segments.

Retargeting: Start with smaller, high-intent audiences to maximize ROI before scaling.

Placement-level optimization: Kill underperforming creatives and placements mid-flight instead of waiting until the campaign ends.

Upfronts and opportunistic buys: Lock in premium inventory early or leverage technology to capture discounted remnant inventory and hone in on potential “fire sales”.

Long-term planning vs. agile buying

Upfronts: Secure premium placements (sports, tentpole events) at predictable rates. This locks in inventory during high‑demand periods and ensures access to cultural moments.

Programmatic/CTV: Stay agile with weekly optimizations and budget shifts.

Blended approach: Use upfronts for reach and programmatic for precision, ensuring efficiency across the full TV spectrum.

Tatari’s Take

TV should be bought like a performance channel:

Measured by results (incremental conversions, not just impressions).

Optimized weekly with log-level transparency.

Benchmarked against other media to ensure efficiency.

Tatari explores opportunities down to the placement level, underperforming creatives and buys can be cut in real time. This ensures no more waiting until the campaign is over to find out what worked and accounts for every dollar to align with business outcomes.

Creative Production

8. How do I make great TV creative without a massive budget?

You don’t need a Madison Avenue production team or a million‑dollar shoot to make effective TV ads. In fact, some of the highest‑performing campaigns are built on clarity, authenticity, and iteration (not mere polish).

Why big budgets aren’t required

Direct-response style works: Founder‑led spots, simple testimonials, or animated explainers often outperform glossy brand films because they feel authentic and actionable.

Shorter formats are effective: Researched data shows that 15‑second and even 6‑second spots can drive strong performance, especially on streaming platforms.

Testing beats perfection: Launching multiple creative variations and optimizing weekly is more valuable than spending months perfecting a single hero ad.

Cost‑efficient creative approaches

Founder or team‑led ads: A direct message from the brand’s leadership can feel personal and trustworthy.

Animation or motion graphics: Affordable, flexible, and easy to update for different campaigns.

Repurposed content: Adapt social video, customer testimonials, or product demos into TV‑ready spots.

AI‑assisted production: Use AI tools to generate scripts, voiceovers, or even rough cuts, lowering production costs and speeding up iteration. AI can help brands test multiple shorter variations quickly, making commercials cheaper to produce and more efficient to optimize.

Creative best practices

Single clear message: Don’t overload the spot: focus on one key benefit or CTA.

Strong call‑to‑action: Drive viewers to a specific action (download, visit, subscribe).

Test multiple versions: Run A/B and multivariate tests on messaging, length, and visuals to see what resonates.

Tailor to platform: Streaming ads can be shorter and more direct, while linear may benefit from slightly longer storytelling.

Tatari’s Take

Creative is not a sunk cost: it’s actually a lever for optimization. Tatari measures performance down to the creative level, so you’ll know which messages actually drive conversions, not just which ones win awards. By treating ad creative as a test‑and‑learn process, brands can scale what works and cut what doesn’t, all without overspending on production.

AI and Automation

9. How does AI fit into TV buying?

AI is transforming TV advertising, but only when it’s grounded in real business outcomes. The promise of AI is speed, scale, and predictive power. The risk is over‑reliance on algorithms without accountability. The winning approach is a partnership between human and machine that uses AI to enhance, not replace, strategy.

Where AI adds value

Media planning: AI can analyze historical performance, audience data, and inventory availability to recommend optimal media mixes across linear and streaming.

Forecasting & prediction: Machine learning models can predict which placements, dayparts, or creatives are most likely to drive conversions.

Budget allocation: AI can dynamically suggest shifting spend toward higher‑performing platforms or audiences mid‑flight.

Creative optimization: AI tools can generate multiple ad variations, test messaging angles, and identify which creative resonates best with different segments.

What AI can’t do alone

Guarantee outcomes: Algorithms can predict, but they can’t prove causality. Incrementality testing is still required to confirm lift.

Replace human oversight: AI lacks the context of brand strategy, seasonality, and cultural nuance. Human judgment ensures campaigns align with broader business goals.

Eliminate fraud risk: AI can flag anomalies, but outcome‑based measurement is the only way to ensure bots aren’t inflating results.

The Tatari approach

Tatari has pioneered AI‑powered media buying across both linear and streaming TV. Their system uses machine learning to:

Optimize media plans in real time.

Predict performance at the placement level.

Recommend budget reallocations based on outcome data.

But critically, Tatari doesn’t “blindly trust” AI. Every recommendation is validated through incrementality testing and human oversight. This ensures AI is judged by what it drives — visits, installs, purchases — not just what it predicts.

Why this matters for marketers

Efficiency: AI accelerates planning and optimization, freeing teams to focus on strategy.

Agility: Campaigns can adapt weekly instead of quarterly, reducing wasted spend.

Confidence: By combining AI with outcome‑based measurement, marketers get both speed and accountability.

Tatari’s Take

AI is a powerful assistant but should not be seen as a silver bullet replacement for good strategy and thoughtful creativity. The future of TV buying isn’t “AI vs. humans,” it’s AI + humans, working together to make TV as measurable, accountable, and efficient as digital.

Case Studies and Best Practices

10. What are others doing that’s working?

The brands winning on TV in 2025 aren’t just buying impressions. They’re treating TV as a performance channel that integrates seamlessly with their broader media mix. Success comes from a combination of strategy, measurement, and agility.

Common traits of successful TV advertisers

Treat TV like digital: They measure outcomes (visits, installs, purchases) instead of relying on CPMs or GRPs.

Blend linear + streaming: Linear delivers cultural reach (sports, live events), while CTV provides precision targeting and rapid optimization.

Test creative variations: Instead of betting on one hero spot, they run multiple versions and scale what performs.

Measure incrementality: They prove lift with deterministic testing, not just attribution models.

Integrate full‑funnel: TV is used for awareness, acquisition, and re‑engagement—often in the same campaign.

Examples of what’s working

Made In (Cookware): Scaled their business by blending direct‑response creative with lifestyle storytelling. TV drove both immediate conversions and long‑term brand equity.

Calm (Meditation app): Leveraged TV to drive app downloads and subscriptions, showing that even digital‑native brands can scale through TV.

Fiverr (Marketplace): Used TV as part of its performance stack, optimizing creative and placements weekly to drive sign‑ups.

Saatva (Mattresses): Saw measurable increases in site visits and conversions after launching TV campaigns, proving TV can be a direct acquisition engine.

Why these brands succeed

They don’t silo TV. Instead, they integrate it with search, social, and CRM.

They optimize weekly, reallocating budget to top‑performing placements.

They use TV for both acquisition and retention, not just awareness.

They demand transparency, knowing exactly where ads ran and what they delivered.

Tatari’s Take

The playbook is evolving, but the winners are those who treat TV as part of a full‑funnel, data‑driven strategy. By combining linear reach with streaming precision, testing creative aggressively, and measuring incrementality, brands can make TV accountable and scalable, just like digital.

Ready to unlock the power of data-driven TV advertising? Request a demo with Tatari today!

Michael Goldberg

I lead content at Tatari. When I’m not writing, I’m reading, watching The Office (again), hopelessly rooting for the Mets and Jets, and blasting heavy metal.

Related

The MLB Postseason Delivered Grand Slam Results for TV Advertisers

Learn how smart planning turned the MLB postseason into a win for brands like Rocket Money, Gusto, Ariat, and more.

Read more

TV's Powerful Halo Effect: What It Is, How Tatari Measures It, and How You Can Harness It

Think Instagram is driving all your sales? Think again. Tatari data shows that TV ads quietly supercharge every other channel—boosting conversions on social, email, and beyond by over 50%. See how we help brands measure TV's full halo effect.

Read more

Why Retargeting Might Be TV’s Smartest Entry Point

CTV is transforming traditional retargeting by combining the engagement of TV advertising with the precision of digital targeting, offering brands a low-risk, high-impact way to drive conversions and test a powerful new performance channel.

Read more