What Marketers Should Know About Advertising on Amazon Prime Video (Before You Buy)

As streaming continues to reshape how Americans consume premium video, Amazon Prime Video has emerged as one of the most powerful platforms for advertisers. With unmatched scale, exclusive live sports, blockbuster originals, and direct integration into Amazon’s retail ecosystem, Prime Video delivers both cultural impact and measurable outcomes. Its combination of premium entertainment, commerce integration, and closed-loop attribution makes it a cornerstone for modern CTV strategies.

This guide examines platform data, media best practices, and strategic insights to help marketers understand how to activate, measure, and optimize campaigns on Prime Video in 2025 and beyond.

The Amazon Prime Video Platform at a Glance: Scale, Reach, and Strategic Value

Amazon Prime Video (APV) is one of the largest ad-supported streaming platforms in the U.S., reaching over 132 million viewers in 2025. This represents over 39% of the U.S. population, and importantly, 88% of these viewers who have shopped on Amazon. This creates a unique bridge crossing entertainment and commerce.

Prime Video is bundled with Amazon Prime memberships ($14.99/month or $139/year) and also available as a standalone subscription ($8.99/month), giving advertisers access to a high-value audience with strong purchase intent and loyalty.

Key Benefits:

Built-in audience scale with high shopping intent

Cross-platform synergy with Twitch, Fire TV, and Amazon.com

Exclusive live sports (Thursday Night Football [TNF], NBA, NASCAR, WNBA)

Top-performing originals like Fallout, Reacher, and The Boys

Full-funnel measurement from impression to purchase

Amazon’s Approach to Ads: Inventory, Formats, and Frequency

Amazon Prime Video’s advertising ecosystem is designed to balance viewer experience with brand impact, offering marketers a wide range of inventory, innovative formats, and flexible buying models. Unlike traditional TV, where ad loads are heavy and targeting is broad, Prime Video integrates ads seamlessly into premium content environments—whether that’s a blockbuster original, a live NFL game, or a binge-worthy series.

1. Ad Load and Viewer Experience

Light Ad Load: Standard Prime Video programming averages 4-5 minutes of ads per hour, significantly lighter than linear TV (13–18 minutes) and competitive with other streamers.

Event-Based Flexibility: Live sports and tentpole events carry higher ad frequency, but Amazon offsets this with less intrusive dynamic overlays, sponsorships, and interactive units.

Viewer-Friendly Formats: Ads are designed to be non-skippable but concise. This ensures high completion rates without overwhelming the audience.

2. Inventory Types

Prime Video inventory spans across Amazon-owned and -operated properties and partnered streaming environments which give advertisers both scale and flexibility.

The most notable environment is in live sports with exclusive rights to the NFL’s Thursday Night Football, NASCAR, WNBA, and NWSL which intends to deliver mass reach at lower CPMs than linear TV.

This deeper foray into live sports includes the new rights deal Amazon Prime Video signed with the National Basketball Association (NBA) beginning with the 2025-26 season. Amazon Prime Video will stream 66 regular‑season NBA games, including an opening week doubleheader, a new Black Friday showcase, and all games from the Emirates NBA Cup knockout rounds. The package also includes exclusive coverage of the SoFi NBA Play‑In Tournament, select early‑round playoff games, and Conference Finals in six of the 11 years of the agreement.

This landmark deal positions Prime Video as a central hub for basketball fans and creates premium sponsorship opportunities around one of the most advertiser‑friendly sports properties.

In addition to the expansion of live sports offerings, Amazon Prime Video will offer advertising opportunities among:

Amazon Originals & Licensed Content: High‑engagement shows like Fallout, Reacher, and The Boys provide premium placement opportunities.

Streaming TV (STV+): Access to third‑party apps and broadcasters across Fire TV which allows for expanding reach beyond Prime Video itself.

Twitch Integration: Incremental reach among younger, hard‑to‑reach audiences, with interactive ad opportunities.

3. Ad Formats

Amazon boasts one of the most innovative ad toolkits in streaming. Formats range from standard video to highly interactive, commerce‑enabled units:

Ad Format | Description | Best Use Cases | Pros | Cons |

|---|---|---|---|---|

Standard Video Ads | Pre-roll, mid-roll, or post-roll (15-90 second runtime) | Broad reach, brand awareness | High visibility, non-skippable (Amazon Ads) | Requires multiple creatives to avoid fatigue |

Interactive Pause Ads | Displayed when viewers pause content; includes shoppable or info options | Engagement, lead generation | High attention, actionable moments (Amazon Ads) | Limited to pause events; requires creative alignment |

Add-to-Cart Overlays | Real-time product info with “Add to Cart” button during ad playback | Retail campaigns, endemic brands | Drives direct purchase (Amazon Ads) | Requires Amazon product listings |

Contextual Pause Ads | AI-powered ads tailored to paused content | Travel, lifestyle, entertainment | Relevance boosts engagement (Amazon Ads) | Limited to Prime Video inventory |

First Impression Takeover | Full-screen takeover at app launch or content start | Launches, tentpoles, high-impact branding | Unmissable; premium placement (Amazon Ads) | Higher CPM; limited availability |

Sponsorship Bumpers | “Brought to you by” bumpers around specific titles | Cultural alignment, brand lift | Deep engagement (Amazon GTM Q3 2025 Update) | Investment starts at $250K |

Shoppable Formats | Real-time product info with cart integration | Endemic brands | Seamless commerce integration (Amazon Ads) | Requires Amazon listings and creative setup |

Discovery Formats | Off-Amazon engagement (e.g., “Send to Phone”) | Lead gen, service brands | Drives off-platform action (Amazon Ads) | Less direct attribution |

4. Buying Models

Amazon offers flexible activation paths to suit different advertiser needs:

Premium Sponsorships: Upfront buys into tentpole shows, sports, or cultural moments which are ideal for brand lift and cultural alignment.

Programmatic Guaranteed: Locked‑in impressions via Amazon DSP which ensures delivery at predictable CPMs.

Programmatic PMP (Preferred Entry Point): Biddable access with negotiated CPM ranges which offers flexibility and efficiency.

Open Auction (STV+): Broader reach across Fire TV and partner apps with a dynamic pricing structure.

5. Strategic Advantages

What sets Amazon apart is the integration of entertainment and commerce:

Closed-Loop Attribution: Endemic brands can measure ad exposure all the way to purchase, down to the ASIN level.

Cross-Platform Retargeting: Viewers exposed on Prime Video can be retargeted across Amazon.com, Twitch, and Fire TV.

Interactive Innovation: Formats like pause ads and add‑to‑cart overlays drive 6.3x more cart adds and 2.5x more orders compared to standard video.

Cost Efficiency: Live sports CPMs are 40–50% lower than linear TV, while Tatari-negotiated PMP rates start as low as $16.39 CPM.

6. Why It Matters for Marketers

Amazon’s approach to ads is not just about reach. It’s about outcomes. Prime Video will enable advertisers to run campaigns as measurable as digital media - and with the cultural impact of classic television - by combining:

Scale (132M+ U.S. viewers)

Data (1P shopper insights)

Formats (interactive, shoppable, sponsorships)

Measurement (closed-loop attribution)

Audience Targeting and Data Capabilities

Amazon’s targeting infrastructure is powered by its proprietary first-party shopper data. This enables advertisers to reach audiences with both precision and scale.

Targeting Options:

Demographic: Age, gender, income, geography

Behavioral: Viewing habits, genre preferences

Psychographic: Interests, lifestyle, family status

Device-Level: CTV, mobile, desktop, Fire TV

Custom Audiences: CRM uploads, lookalikes, 3P integrations

Analytics, Measurement, and Performance Metrics

Amazon Prime Video offers closed-loop attribution for endemic brands and robust off-platform tracking for non-endemic advertisers.

Measurement Capabilities:

Impressions, view-through rates, completion rates

Unique reach and frequency by device and segment

ASIN-level purchase tracking for endemic brands

Retargeting across Amazon.com, Twitch, and Fire TV

Brand lift studies via Amazon Shopper Panel

3P measurement via EDO, Dynata, Kantar, Lucid, Upwave

Advertisers can measure cost-per-visit (CPV), cost-per-acquisition (CPA), and return on ad spend (ROAS), with real-time reporting through Tatari and Amazon DSP integrations.

Best Practices for Amazon Prime Video Advertising

Advertising on Amazon Prime Video requires more than simply placing creative into premium content. To maximize impact, brands should align messaging with the platform’s unique strengths, from its lighter ad load and exclusive live sports to its integration with Amazon’s retail ecosystem.

Success comes from pairing thoughtful creative with precise targeting, leveraging interactive formats, and continuously optimizing campaigns based on real-time performance data. These seven best practices help ensure that every impression delivers measurable value while strengthening brand presence in one of the most influential streaming environments.

1. Align Creative With Content

Prime Video’s originals and live sports are widely popular. Therefore, creative which feels native to the viewing environment performs best. For example, aligning a tech brand’s messaging with the futuristic tone of Fallout or a fitness brand with the intensity of Reacher can increase recall and favorability.

Advertisers should also consider contextual placements, such as travel ads during lifestyle programming or family-focused messaging during kids’ content. The goal is to ensure the ad feels like a natural extension of the content rather than an interruption.

2. Leverage Amazon First-Party (1P) Data

Amazon’s first-party (1P) shopper data is one of its most powerful differentiators. Brands can target based on in-market behavior (e.g., consumers browsing fitness apparel), lifestyle segments (e.g., outdoor enthusiasts), or purchase history.

Amazon 1P data allows advertisers to reach audiences who are not only watching but also actively shopping. For endemic brands, this allows retargeting viewers who have visited product detail pages. For non-endemic brands, it means building modeled audiences that mirror high-value customers. The precision of this data reduces wasted impressions and increases campaign efficiency.

3. Diversify Creative Assets

Much like traditional paid advertising platforms like Google CPC or LinkedIn Ads, Prime Video campaigns require multiple creative variations to avoid fatigue, especially since ads are non-skippable. Advertisers should prepare a mix of 15/30/60 second spots, each with different story arcs or calls to action.

Testing ad variations, such as highlighting product benefits in one version and emotional storytelling in another, helps identify which resonates most with different audience segments. Rotating assets also ensures that frequent viewers do not see the same ad repeatedly, which can lead to negative sentiment.

4. Use Interactive Formats

Interactive formats are where Amazon truly differentiates itself. Pause ads, add-to-cart overlays, and contextual ads transform passive viewing into active engagement.

For example, a beauty brand can allow viewers to add a featured product directly to their Amazon cart during a pause moment. A travel brand can use contextual pause ads to serve destination offers when a viewer pauses a beach scene. These formats not only drive higher engagement but also shorten the path from awareness to purchase, making them ideal for performance-driven campaigns.

5. Sponsor Originals and Tentpoles

Sponsorships around Prime Video originals and live sports deliver outsized brand lift. Titles like The Boys, Gen V, and Beast Games attract passionate fan bases and generate significant social buzz, while live sports like Thursday Night Football and the NBA guarantee mass reach.

Sponsorship packages often include “brought to you by” ad bumpers, pause ad capabilities, and first impression takeovers, which help create multiple touchpoints within a single property. Although these sponsorship packages carry significant investment budgets, the payoff is deeper engagement, stronger brand favorability, and alignment with cultural moments that audiences care about.

6. Retarget Across the Amazon Ecosystem

One of Amazon’s biggest competitive advantages is the ability to retarget viewers across its ecosystem. A consumer who sees a Prime Video ad can later be retargeted on Amazon.com, Twitch, or Fire TV with complementary messaging.

For instance, a viewer who watches an auto brand’s ad during TNF could later see a display ad on Amazon.com promoting a dealership visit. This cross-platform retargeting reinforces brand messaging, increases frequency in a controlled way, and drives consumers further down the funnel.

7. Monitor and Optimize Continuously

Prime Video campaigns should not be “set it and forget it.” With real-time reporting through Amazon DSP (and Tatari dashboards), advertisers can track impressions, completion rates, conversions, and even ASIN-level sales. This data should inform ongoing adjustments, such as reallocating budget to top-performing audience segments, capping frequency to avoid overexposure, or swapping in new creative when performance dips.

This continuous strategic optimization ensures that campaigns remain efficient and effective throughout their flight, maximizing both brand impact and ROI.

Strategic Integration: Amazon Prime Video in Your Media Mix

Amazon Prime Video should be a cornerstone of any modern CTV strategy. Its combination of scale, shopper data, and interactive formats makes it ideal for both brand-building and performance campaigns.

Strategic Recommendations:

Use Prime Video for upper-funnel reach and lower-funnel conversion

Align sponsorships with cultural tentpoles (e.g., Thursday Night Football, NBA, Amazon Original Programming)

Integrate with Hulu, Netflix, and linear TV for incremental reach

Partner with Tatari for transparent buying, AI-powered planning, and outcome measurement

Amazon Prime Video Media Planner Grid (Q4 2025-Q4 2026)

The calendar provides insight into Amazon Prime Video’s tentpoles for the next four quarters (starting with Q4 2025) and spans across scripted originals and live sports. Q4 2025 and Q4 2026 are especially strong for NFL holiday games, NBA Black Friday showcases, and original programming like Fallout and Blade Runner 2099. Q2 2026 is another peak window with Rings of Power Season 3 and the recently-acquired NBA Playoffs.

Quarter | Key Tentpoles | Timing | Audience / Brand Opportunity |

|---|---|---|---|

Q4 2025 | Fallout S2, Blade Runner 2099 S1, Gen V S2, Mr. & Mrs. Smith S2, Upload S4, Hazbin Hotel S2, The Night Manager S2, Amazon MGM Fall Films | Oct–Dec 2025 | Sci‑fi, action, prestige drama, younger demos, awards‑season alignment |

Tuesday Night Football (NFL) | Weekly, incl. Thanksgiving & Christmas | Massive national reach; retail tie‑ins | |

NBA on Prime (launch) | Oct 2025, Black Friday doubleheader | Younger demos; holiday retail | |

NASCAR Playoffs | Fall 2025 | Auto racing fans; male skew | |

WNBA Finals | Oct 2025 | Women’s sports; diverse audiences | |

Q1 2026 | The Boys S5, Beast Games S2, The Terminal List S2 | Jan–Mar 2026 | Flagship franchise, reality competition, action‑thriller |

NFL Playoffs | Jan 2026 | Peak sports viewership | |

NBA (Berlin & London Games) | Jan 2026 | International reach; global basketball fans | |

Australian Open (Prime coverage) | Jan 2026 | Tennis fans; affluent audiences | |

Q2 2026 | Rings of Power S3, Reacher S4, Spider‑Noir (new), Upload S5 | Apr–Jun 2026 | Global fantasy, action‑drama, Marvel IP, tech‑savvy comedy |

NBA Playoffs | Apr–Jun 2026 | Younger demos; high engagement | |

WNBA Season Start | May 2026 | Women’s sports; diverse audiences | |

NWSL Season | Spring 2026 | Soccer fans; family and youth | |

Q3 2026 | Hazbin Hotel S3, Vox Machina S4, Carrie (new), Mr. & Mrs. Smith S3 | Jul–Sep 2026 | Animation, RPG/fantasy, horror, action‑comedy |

NBA Season Kickoff (preseason) | Sep–Oct 2026 | Basketball fans; younger demos | |

NASCAR Summer Races | Summer 2026 | Auto racing fans; male skew | |

Q4 2026 | Blade Runner 2099 (cont.), Ballard S2, Bloodaxe S1, Joseph of Egypt S1, Amazon MGM Fall Films | Oct–Dec 2026 | Prestige sci‑fi, drama, historical epic, faith‑based, awards‑season |

TNF Holiday Games | Thanksgiving & Christmas 2026 | Peak NFL viewership; retail alignment | |

NBA Black Friday Doubleheader | Nov 2026 | Holiday retail showcase | |

NASCAR Playoffs | Fall 2026 | Auto racing fans; male skew | |

WNBA Finals | Oct 2026 | Women’s sports; diverse audiences |

Comparative Analysis: Amazon Prime Video vs. Peacock vs. Hulu

When reviewing different CTV platforms, it’s important to understand how Amazon Prime Video, Peacock, and Hulu differ in the way they present advertising, audience reach, and content strategy. Each service offers a unique mix of pricing models, ad loads, and programming strengths that form the viewer experience and marketer value proposition.

Evaluating these platforms side by side can help advertisers potentially identify where to budget for maximum reach, efficiency, and brand impact.

Feature | Amazon Prime Video | Peacock | Hulu |

|---|---|---|---|

Monthly (Ad / Ad-Free) | $8.99 (standalone) / Included with Prime | $10.99 / $16.99 | $7.99 / $14.99 |

Ad Load (per hour) | 4-5 minutes | 3-5 minutes | 9-12 minutes |

Ad-Free Penetration | ~12% | ~23% | ~32% |

Live Sports | Thursday Night Football (TNF), NBA, NASCAR, WNBA, National Women’s Soccer League (NWSL), more | NFL, Premier League, Olympics, WWE | ESPN via Hulu + Live TV |

Content Library | Originals + licensed + live sports | NBCU, Universal, WWE, Telemundo | Disney, FX, ABC, Fox, 40K+ episodes |

Targeting & Data | Amazon 1P shopper data, AMC, DSP | NBCU 1P + 3P integrations | Disney Select, 3P data, robust segmentation |

Interactive Formats | Pause ads, Add-to-Cart, Contextual, Shoppable | Pause ads, Binge ads, Marquee, Screensaver | Interactive overlays, pause ads, sponsorships |

Measurement | ASIN-level, ROAS, brand lift, 1P + 3P | CPCV, CPV, brand lift, 1P + 3P | Nielsen, Comscore, brand lift, attribution |

Commerce Integration | Direct-to-cart, real-time pricing, Amazon.com | Limited (mostly brand awareness) | Limited (off-platform CTAs) |

Sponsorship Options | Originals, Live Sports, Tentpoles ($250K–$3M) | Originals, Live Events, Cultural Moments | Originals, Live TV, Tentpoles |

Viewer Demographics | Broad, skewing 18–54, high shopper overlap | Millennial-heavy, diverse, urban/suburban | Broad, strong Gen Z and Millennial base |

Incorporating Amazon Prime Video Into Your Streaming Strategy

Tatari offers direct access to Amazon Prime Video inventory, outcome-based measurement, and AI-powered planning to help brands maximize ROI.

Tatari Advantages:

Direct publisher deals for Prime Video sponsorships, interactive formats, and live sports activations

AI-powered media planning to optimize spend, reduce waste, and scale only when performance warrants

Outcome-based measurement including CPV, CPA, ROAS, and ASIN-level attribution for endemic brands

Flexible buying options: self-serve, managed service, or hybrid, all tailored to your team’s needs

Seamless integration with cross-channel dashboards and media mix modeling

Whether you're launching a new product, scaling a performance campaign, or aligning with cultural tentpoles, Tatari helps you unlock the full power of Amazon Prime Video with transparency, precision, and measurable impact.

Let’s build your next-generation TV media plan together. Explore Tatari and schedule a demo today.

Frequently Asked Questions About Amazon Prime Video Ads

Does Amazon Prime Video have ads?

Yes. Amazon Prime Video includes ad-supported programming across originals, licensed shows, movies, and live sports. Ads are integrated into both bundled Prime memberships and standalone Prime Video subscriptions.

Is there a version of Amazon Prime Video that is completely ad-free?

Not entirely. While most on-demand content is available with limited ad interruptions, live sports, licensed programming, and certain tentpole events always include ads due to rights agreements.

How many ads per hour does Amazon Prime Video show?

On average, Prime Video maintains a 4-5 minute ad load per hour for standard programming, which is lighter than traditional TV and competitive with other major streaming platforms.

What kind of ads show up on Amazon Prime Video?

Prime Video serves a mix of standard video ads (15-90 seconds), interactive pause ads, add-to-cart overlays, contextual ads, sponsorship bumpers, and shoppable formats that connect directly to Amazon’s retail ecosystem.

Can I advertise on Amazon Prime Video directly?

Yes. Brands can buy inventory directly through Amazon Ads or work with partners like Tatari to access Prime Video placements, negotiate below-market CPMs, and integrate measurement across campaigns.

Can Tatari track performance on Amazon Prime Video ads?

Absolutely. Tatari can measure impressions, reach, and downstream actions such as site visits, conversions, and even ASIN-level purchases for endemic brands.

What is the ad load on Amazon Prime Video compared to other streamers?

Prime Video averages 4-5 minutes per hour, which is lighter than Hulu’s 9-12 minutes, similar to Peacock’s 3-5 minutes, and significantly less than linear TV’s 13-18 minutes.

How do Amazon Prime Video ads compare to Hulu, Peacock, or YouTube TV?

Prime Video offers lighter ad loads than Hulu, broader commerce integration than Peacock, and more premium originals and live sports than YouTube TV. Its unique advantage is the ability to connect ads directly to Amazon shopping behavior and closed-loop attribution.

Can you skip ads on any version of Amazon Prime Video?

No. Ads on Prime Video are non-skippable, including those in live sports, originals, and licensed programming.

How much budget should my company be prepared to have to successfully advertise on Amazon Prime Video?

Budgets vary by format and targeting, but most campaigns should plan for entry points around $40K–$60K for meaningful reach. Sponsorships and tentpole integrations typically start at $250K and can scale into the millions, while programmatic PMP buys negotiated through Tatari can begin at CPMs as low as $16–$18.

Vicky Chang

I love helping businesses grow.

Related

What Marketers Should Know About Peacock Advertising (Before You Buy)

Peacock’s ad-supported streaming model combines premium on‑demand programming, live sports, and targeted ad formats within a lighter commercial load than traditional television. Its tiered plans give advertisers flexible ways to reach diverse audiences while leveraging NBCUniversal’s premium content environment.

Read more

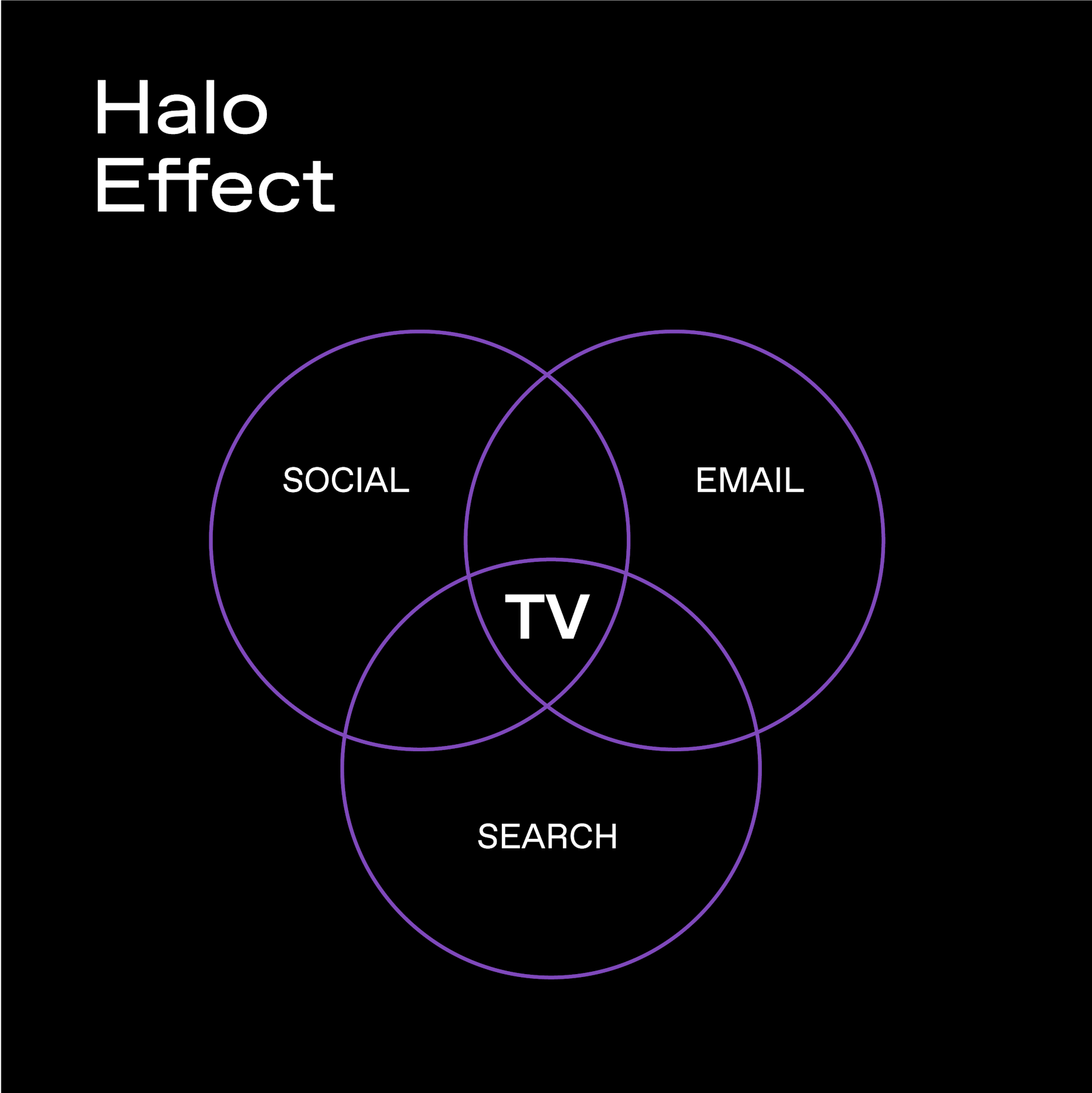

TV's Powerful Halo Effect: What It Is, How Tatari Measures It, and How You Can Harness It

Think Instagram is driving all your sales? Think again. Tatari data shows that TV ads quietly supercharge every other channel—boosting conversions on social, email, and beyond by over 50%. See how we help brands measure TV's full halo effect.

Read more

What Advertisers Need to Know About YouTube and YouTube TV in 2026

Learn the differences between YouTube and YouTube TV in 2026—one built for on-demand, targeted engagement, the other for live, TV-scale reach.

Read more