Marketers are Enamored with the Big Screen but They Risk Missing the Bigger Picture

Many new-to-TV advertisers arrive on the scene after having maxed out on digital channels. Over the years, we have been able to put some real numbers behind this. Once advertisers pass $250,000 a month in social media spend, TV emerges as a channel with lower marginal customer acquisition costs.

As digital experts, these new-to-TV advertisers come with “digital expectations”: they demand real-time and accurate measurement, and an agile, optimized, and transparent buying experience. For all the good reasons, the TV industry was long-time ripe for this.

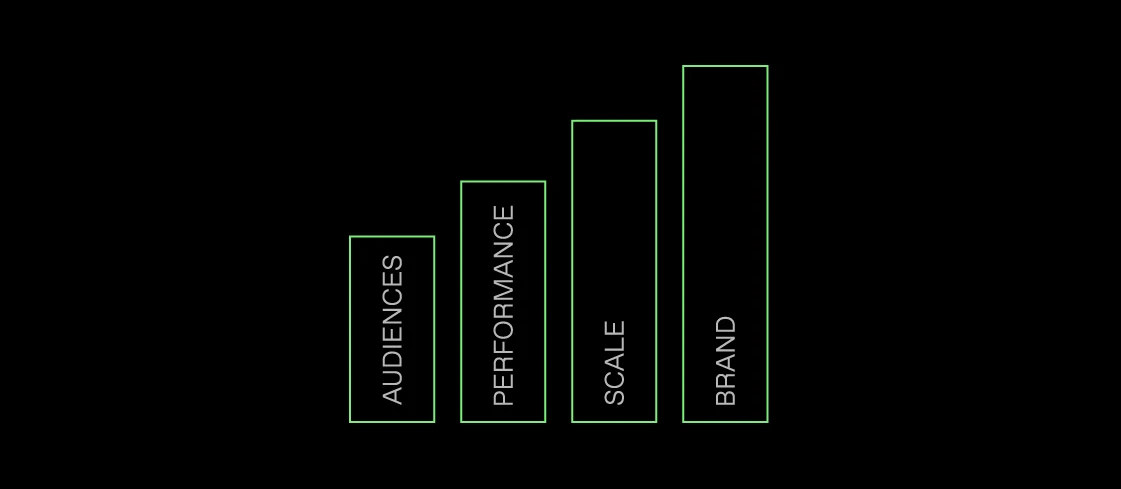

It has, however, also come with a borderline myopic adaptation of the most fundamental part of digital advertising: targeting. Whilst there is definite value in targeting, it eventually leads to brands failing to harness the power of TV advertising. This is best explained by laying out a typical TV advertising journey (with related spend levels).

Optimization for audiences: <$100K/mo in media

Most brands exploring TV advertising for the first time will try to find their sweet-spot audience target, as discerned in digital campaigns or surveys. Unlike a decade ago, this is now totally possible. Out-of-the box DSP technology (e.g. Roku, Beeswax, MNTN, or TheTradeDesk) enables advertisers to pick up impressions across publishers based on laser sharp defined demographic, psychographic, or contextual targeting parameters. Initiatives such as UID2.0 can even stretch TV beyond digital capabilities in terms of audience targeting. Performance (as measured through a plethora of KPIs such as visits, installs, new incremental reach, or sales) doesn’t, however, always follow. The reasons for this are multifold:

Pricing of media: for every added layer of targeting, the CPM will (rightfully) creep up.

Media execution: purchasing impressions through a DSP-SSP programmatic path ads 40-60% in ad tech fees.

Even in the instances where (hyper)-targeting does work (and retargeting is a perfect example of this), it lacks scale. After all, apply an infinite amount of targeting parameters and the addressable audience will shrink to a few thousand people.

Optimization for performance: <$250K/mo in media

As advertisers come to this realization (and this can happen in a matter of days!), they also start seeing pockets of unexpected performance. It can present itself in many ways i.e. a male-centric creative enjoys a stronger response from females, a mobile gaming app for a young demographic drives installs from a 50yo+ cohort, etc. Often under pressure from CEOs and boards, digital growth marketers will shift gears overnight and optimize the campaign for performance, not audiences. This is outcome-based marketing, and it underlines the importance of (superior) TV measurement. The first time brands experience this TV euphoria, it also becomes a little bit like a drug: they will eventually want more.

Optimization for scale: <$1M/mo in media

Outcome-based marketing is virtuous in the sense that when it works, budgets will continue to increase. However, there is a ceiling to this. The lower CPM performance channels start to max out (or worse: ads are delivered with over-frequency). Moving beyond requires an optimization for scale, which is mostly a combination of:

Buying media directly (and bypassing programmatic exchanges). It is not uncommon for CPMs to drop 60%, and boosting performance by another ~70%.

Loosening targeting parameters even further (possibly buying cheap, untargeted, run-of-network!) and meticulously monitoring performance against it.

Layering in linear TV. Apart from new audiences, the linear cousin of a streaming publisher will typically come at a third of the price (e.g. $3 linear vs $10+ streaming CPM).

At Tatari, we have found that most brands can clinch this optimization for scale by probing in times of low inventory pricing, such as Summer, not Q4.

Optimization for brand: $1M+/mo in media

TV advertising transcends its direct relationship to sales. TV ads have the power to project quality and prestige, using rich media in a relaxed setting of the living room. It will positively impact search results (e.g. non-profitable keywords perform), social media campaigns (e.g. Facebook click-through rates edging up) and build in-store recognition. Recognizing this indirect (and delayed) impact is undoubtedly the hardest step in TV advertising. The outcome-based KPIs such as CAC and ROAS that have served us so well need to make room for Reach and Frequency metrics (and related derivatives, e.g. cost per Reach). Worse: it requires that advertisers buy high-reach, premium inventory, often only found in linear (limited targeting), at high CPM (the super bowl is like $50 CPM), and months in advance (the super bowl 2023 is mostly sold out). Achieving this, however, is harnessing the true power of TV: reach and brand.

As CTV/OTT experiences displace cable and broadcast, it will ever be so important for growth marketers to be able to look beyond audience targeting. Getting into TV stretches well beyond buying CTV inventory through a DSP. Understanding the full journey ahead leads to selecting the right partners early on, and will help paint the picture (with clear expectation setting) to senior management.

Philip Inghelbrecht

I'm CEO at Tatari. I love getting things done.

Related

Full Funnel Focus: Vuori's TV Advertising Journey

Tatari and our friends at GROW celebrated the return of in-person events with an epic gathering in Beverly Hills. Watch the full talk to understand how Vuori went from developing their first-ever spot to leveraging TV as a primary performance channel to drive both brand awareness and lower-funnel metrics.

Read more

How Calm Used Digital Tactics to Master TV Brand Advertising

Learn how Calm used data & analytics to drive customer acquisition, found audiences at scale, and ultimately launched a large-scale brand campaign featuring NBA star LeBron James to become the No. 1 Mental Fitness App, with over 70 million downloads.

Read more

5 Tips for Setting Up a Successful Programmatic Retargeting Campaign on TV

The rise of CTV has helped bridge the best practices of digital and TV advertising. Now, advertisers can replicate one of digital’s best-performing tactics – retargeting – on the biggest and most engaging screen in a consumer’s household.

Read more