How 4 DTC Disruptors Use Digital Best Practices to Succeed on TV

This article was originally featured on Adweek.

Disruption and opportunity are the same thing, right?

TV advertising has traditionally been an exclusive club with an extremely high initiation fee. It was the domain of the Doritos, Bud Lights, Tides and Fords of the world, companies that would spend millions simply building brand awareness.

But like many things in marketing these days, the combination of data and technology has blown the door of this exclusive club wide open. With the application of data science to media planning and buying, targeting, and measurement, TV has proven its worth as a performance channel.

Gone are the days of age/sex demos, panels and GRPs. TV today is all about wielding metrics to optimize campaigns to hit KPIs and drive tangible outcomes.

And upfront buying? That model has proven ill-suited to an era where rapid changes in consumer behavior require marketers to be agile and responsive with their media plans.

Fast-growing direct-to-consumer brands have long been uncomfortable with the idea of buying swaths of upfront inventory at set prices. The model has always stood as an affront to the performance-based, outcomes-driven mindset behind the companies that represent the future demand base for TV inventory.

DTC brands are reaching a point of diminishing returns through the social media channels they used to launch their brands and build their loyal followings and are now looking to TV as their next frontier for customer acquisition.

TV represents a promising channel for massive reach and massive growth, but its emergence as a performance channel hinges on whether it can be measured with the transparency and precision of a digital buy.

Unsurprisingly, these DTC brands are also now leading the way in using data and measurement to drive TV performance against KPIs like Customer Acquisition Cost (CAC), Cost Per Visitor (CPV) and Return on Ad Spend (ROAS). They are breaking new ground in the discipline of agile, accountable TV advertising, and their example offers lessons for marketers of every scale.

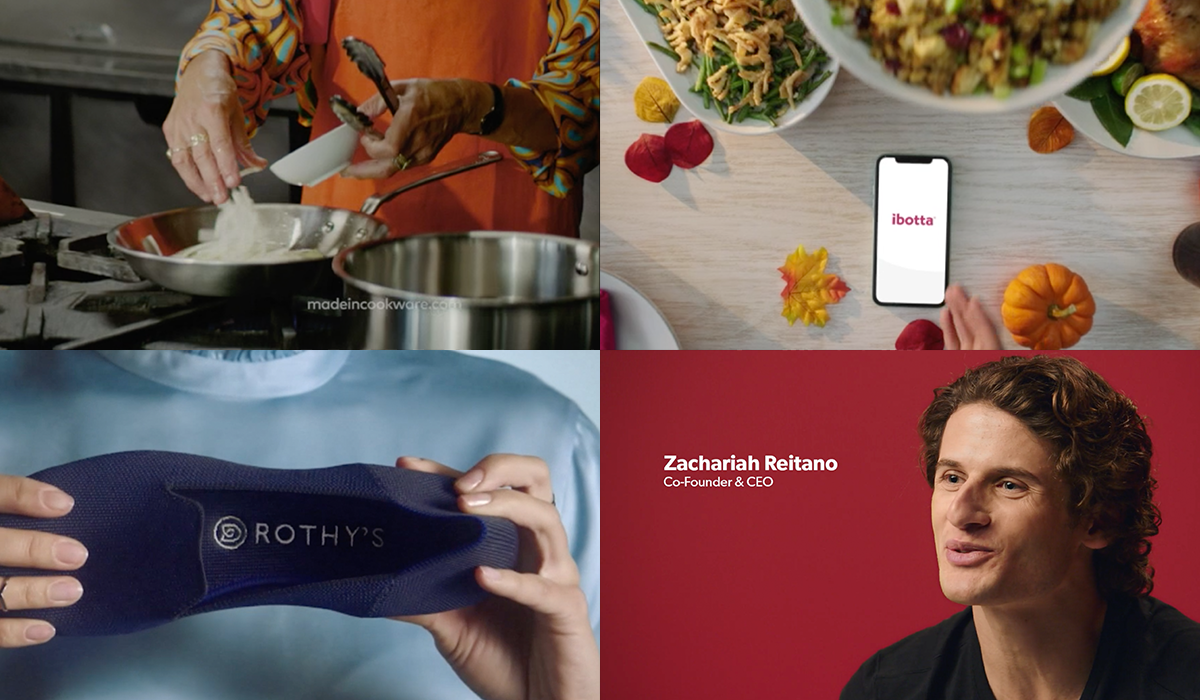

So, let’s take a candid, hands-on look at how four top DTC brands—Roman, Made In, Ibotta and Rothy’s—are using a data-driven approach to drive performance with TV advertising. Each of the case studies explores a specific tactic you can apply to your TV strategy. Taken together, they should serve as some serious inspiration for brands and advertisers of all shapes and sizes.

MADE IN

Nimble buying secures massive reach at a fraction of the cost

THE BRAND

Founded by two best friends with a family legacy in kitchen supply, Made In is on a mission to rethink the kitchen landscape by partnering with the best raw-material providers to build superior tools that are accessible to home chefs and Michelin restaurateurs alike.

THE AD

THE CHALLENGE

Made In is built around rethinking old ways of doing things, a love of cooking and an appreciation for high-quality products. With this universal message, it didn’t make sense for the brand to only chase super-precise target audiences on social media. Plus, as co-founder Chip Malt explained, the brand has incredibly rich and cinematic stories to tell, and it would be a disservice to keep storytelling confined to the 4x5 Facebook ad.

With all of this in mind, the brand knew its message belonged on a mass-media platform. But it didn’t make sense to approach TV through the traditional upfronts model. Made In wanted the same KPIs that drove its successful digital campaigns to guide its TV investment. The challenge was to leverage the broad reach of TV to tell its story in an authentic way while staying agile and data-centric.

THE STRATEGY

Not being committed to upfront deals allowed Made In to make real-time decisions based on the behaviors it saw in a market newly disrupted by Covid-19. This meant working with Tatari to take a clear-eyed look at programming lineups and using data science to evaluate new TV viewership trends. For example, it could look at a $10 CPM in tandem with the data available, and see that because viewership was much higher than was being reported, the CPM was really more like $15.

Another advantage of this data-driven scatter approach was being nimble enough to take advantage of fire sales to achieve massive reach on premium networks at a fraction of the cost. With the help of the Tatari team and dashboards, the brand could tweak creative and placements and reallocate spend until it found the combination that could deliver the performance Made In was looking for.

THE RESULTS

Overall, buying into fire sales on premium networks and being willing to test and learn to find the right channel mix and creative elements led to Made In blowing its KPIs out of the park and getting huge spikes in traffic. The cost-savings were jaw-dropping as well. For example, the team was able to secure a dish spot that typically cost $8,500 dollars at 60% off for $3,400 and achieve a huge response at a fraction of the cost.

Q U I C K T I P

Uncertain times create unprecedented opportunities. Made In jumped on fire sales to buy premium placements at less than half the typical cost.

After the initial positive feedback, the Made In team doubled spend week over week with the same results. Currently, the cookware brand is examining its network mix to hit the sweet spot between budget-friendly and performance, letting it move away from networks that might be increasing their CPMs.

THE LESSON

Staying agile during normal times is important, but during times of uncertainty it’s critical to ensuring you’re in a place to take advantage of real-time shifts in the media market and viewership. If you want to be able to stay nimble and change creative and placements as you test and learn, be wary of hard commitments. It’s important to stay alert to events that could create opportunities like the fire sales Made In capitalized on.

ROTHY'S

Linear and streaming TV were never meant to be separate

THE BRAND

Rothy's transforms earth-friendly materials into timeless shoes, handbags and accessories. Launched in 2016, Rothy's has cultivated a passionate, growing customer base over the past five years.

THE AD

THE CHALLENGE

After hitting $140 million in revenue and selling more than one million shoes in 2018, Rothy’s needed to expand brand awareness and tell its story in a new way. TV was an obvious next move. As Elie Donahue, Rothy’s SVP of marketing, told Adweek: “The way we’re thinking about it is both awareness and getting people to feel good about Rothy’s and hopefully getting them to convert and try on shoes.”

The goal, she added, was to reach previously untapped demographics that would “love Rothy’s just like our core customers.”

Rothy’s message and product are appealing to women across geographies and demographics, so the team needed to focus on driving cost-efficiency without limiting themselves and potentially missing the consumer where she was.

THE STRATEGY

After running with a combination of channels, the team at Rothy’s found that spending a little over half of their budget on linear allowed them to reach audiences at scale and hit their KPIs. But reserving a sizable chunk for streaming helped reach targets who weren’t watching on linear and made the overall strategy stronger.

What really allowed this mix to succeed is the holistic approach the team took. They didn’t separate out each channel’s results or think of them as separate entities, but worked with Tatari to employ a universal measurement system that blended performance results from both.

By doing so, Rothy’s was able to keep a high-level view and stay focused on its goal of getting in front of the biggest group of people possible while staying cost effective.

THE RESULTS

Using this holistic approach, Rothy’s was able to drive efficiency at scale on linear while still reaching its target audiences on streaming TV. It’s important to note that because the brand was working with Tatari, it was able to measure reach and frequency using data from 20 million-plus devices on linear TV and have a 100% understanding of when/where an impression on streaming TV fell.

Using this data, the team at Rothy's successfully optimized their linear and streaming mix to hit a range of age demographics with a focus on their target audience and the audience that drives the most conversions.

THE LESSON

Streaming and linear can effectively be used in tandem to drive results and should be thought of as tools that can work together to reach a larger goal. Evaluate the characteristics of each channel in terms of viewership and programming and allocate budgets to align with your performance goals. Once you find something that works, it’s natural to want to just run with that. But as Kate Barrows, growth director at Rothy’s emphasized, it’s important to use those learnings, but equally as important to keep testing and reevaluating as the market changes.

IBOTTA

A measurement-first approach to acquisition

THE BRAND

Ibotta is a Denver-based mobile technology company that lets users earn cash back on purchases made in-store or online via the Ibotta app or browser extension. The company has paid out over $800 million in cash rewards and its app has been downloaded over 40 million times since Ibotta was founded in 2012.

THE AD

THE CHALLENGE

Like many of its DTC counterparts, Ibotta turned to TV once it hit a saturation point with its digital channels. Its challenge was unique to its mobile foundations: Use TV as a performance channel to drive installs and reach a broader audience than it could with digital.

THE STRATEGY

Ibotta’s approach purposefully begins at the end—with measurement. Working with Tatari, the team measures TV like digital, with closed-loop, IP-level data that lets them see direct responders and identify viewers who were exposed to the ad and downloaded the app later. Using Tatari’s dashboard, Ibotta can measure top and down-funnel metrics and the direct impact linear and streaming placements have on installs.

After an initial test yielded encouraging metrics, Ibotta was able to focus on performance optimization. As Brooke O’Brien, Ibotta’s senior marketing manager, explained: “The ability for us to measure the cost-per-install (CPI) and lower-funnel KPIs on streaming TV is critical for optimizing our advertising strategy.”

By being hyper-focused on optimizing around metrics, Ibotta has been able to apply its knowledge of its customers to take advantage of the market and scale while staying nimble.

THE RESULTS

Overall, O’Brien and her team reported a high rate of acquisitions at a reasonable CPI and saw a significant lift in installs after running higher-reach spots during key seasonal windows. Ibotta also saw a general lift on digital channels after running TV ads, proof of TV’s halo effect.

THE LESSON

By staying focused on the data it was getting back, Ibotta was able to tweak the strategy until it found the mix of linear and streaming TV that could get the results it wanted. Take a page from Ibotta’s book by entering TV with a specific goal or KPI in mind and then staying hyper-focused on using data to adjust campaigns until that goal is reached.

ROMAN

Incrementality to reduce waste, find new audiences and optimize

THE BRAND

There is no industry riper for disruption than healthcare and that’s where Roman comes in. A digital health clinic for men, Roman is on a mission to improve the lives of men and their partners by making high-quality care accessible and convenient.

THE AD

THE CHALLENGE

As part of a larger play for mass brand awareness, Roman identified election week as a key opportunity to get in front of the thousands of Americans who would be glued to their TV screens. Working with Tatari, Roman came up with a linear plan it felt would see strong clearance, despite increased rates. Crucial to this was a modern, incremental approach to measurement that utilized Tatari’s data-driven tools and dashboards to understand the true impact of each TV spot.

THE STRATEGY

Let’s start with some definitions. Incrementality separates new visitors, buyers or installers from the users that would have already taken action without seeing the TV ad. The alternative is a view-through (or last-touch) approach that gives credit to whatever media a consumer viewed before taking action.

For Roman, this was critical because it needed to understand the true impact of its TV ads to optimize for efficiency and trim wasted impressions by platform, frequency and device. This also allowed Roman to deduplicate audiences and understand what platform drove the most unique conversions.

With linear, Roman used Tatari’s dashboard to analyze CPV, conversion rates and CPA performance to understand which networks were most efficient. Next, Roman's planners and buyers removed the weakest networks and optimized the remainder for daypart, day of the week, creative, CPMs, etc. The brand then let those changes build on frequency to get a strong read on overall impact. Roman also incorporated streaming to get in front of an incremental audience that wasn't overlapping with linear.

THE RESULTS

The election week campaign saw a 57% improvement in efficiency compared to Roman’s average for solely incremental performance. Karina Rhem, Roman’s offline media manager, also noted that the majority of people (66%) watching news through streaming were incremental and ultimately didn't overlap with any other national campaigns, creating zero room for waste.

THE LESSON

Incremental measurement will allow you to understand what networks and publishers are adding value relative to the rest of your mix. It also allows for precision and can help you optimize in a granular way and feel confident that your ads are having the intended impact. However, Rhem noted that with streaming TV she does toggle between incremental and view-through—a key feature in the Tatari dashboard. This is because Roman often sees a bigger gap in performance, since streaming TV tends to mirror digital, with people likely having had other touchpoints with the brand. This kind of flexibility and willingness to try different approaches is a key part of any successful TV strategy.

Amit Sharan

I run marketing at Tatari and have the world's cutest french bulldog.

Related

How Calm Used Digital Tactics to Master TV Brand Advertising

Learn how Calm used data & analytics to drive customer acquisition, found audiences at scale, and ultimately launched a large-scale brand campaign featuring NBA star LeBron James to become the No. 1 Mental Fitness App, with over 70 million downloads.

Read more

Video: Leading growth marketers discuss TV as a performance channel

We were recently joined by leading growth marketers, Junior Reyes (Resident), Aaron Pelander (GovX), and Dan Guy (Lemonaid Health) to discuss how they’re utilizing TV as a performance channel.

Read more

Video: How Fubo, a Live TV Streaming Platform, Used TV ads to Drive Subscriptions

Tatari was recently featured on VAB’s Industry Spotlight Webinar with Alberto Horihuela, Co-Founder & CMO of fuboTV, to share their journey through linear TV advertising.

Read more